Transform CX with AI at the core of every interaction

Unify fragmented interactions across 30+ voice, social and digital channels with an AI-native customer experience platform. Deliver consistent, extraordinary brand experiences at scale.

How to Calculate Churn Rate [+ 7 Tips to Reduce it]

Today, retaining customers is as crucial as acquiring new ones. The churn rate, which measures the percentage of customers who stop using your product or service over a given period, has become a vital indicator of a company’s overall health and long-term sustainability. Understanding how to calculate and reduce churn is key to thriving in a competitive market.

Take the mobile app industry as an example. A popular productivity app may draw thousands of downloads, but the churn rate quickly escalates if users drop off after a few weeks due to poor user experience or a lack of timely updates. To counter this, app developers often release new features, fix bugs and keep users engaged through personalized notifications. In fact, studies have shown that improving customer experience can reduce churn by up to 15% and boost win rates by nearly 40%.

Though the concept of churn rate seems straightforward, both calculating it and taking steps to reduce it involve several moving parts. In this guide, we’ll break down how to calculate churn rate and share seven actionable strategies to help you minimize it — so you can keep your customers happy and your business growing.

What is a customer churn rate?

Customer churn rate is the percentage of customers a business loses over a specific period. It is calculated by dividing the number of customers a business loses (in a time frame) by the number of customers it started with (in the same time frame).

Example: Let's assume you started a quarter with 100 customers and at the end of the quarter, you have 90. This means that you lost 10 customers during the time frame. Your churn rate for the quarter would be (10/100) x 100 = 10%

A churn rate of 10% means you lost 10% of your customer base within that quarter. While that might seem small, consistently losing customers can add up quickly, affecting your bottom line and growth potential. That’s why keeping a close eye on customer churn is essential for long-term success.

Customer churn in B2B vs. B2C

Customer churn looks different in B2C and B2B. This is mainly due to differences in customer behavior and relationship dynamics. The table below outlines key distinctions:

Aspect | Customer churn in B2B | Customer churn in B2C |

Churn rate | Lower churn rates due to long-term contracts and relationships | Higher churn rates as customers can switch easily |

Decision making | Involves multiple stakeholders, making churn less frequent but impactful | Quick decision-making by individuals leads to higher churn |

Causes of churn | Unmet service expectations, changes in business needs | Price sensitivity, product dissatisfaction or competitive offers |

Retention focus | Personalized service and deep customer engagement | Rewards programs, personalized offers and customer experience |

Emotional factors | Less reliant on emotional factors, more on value and service | Brand loyalty and emotional connection play significant roles |

Customer churn rate vs. Revenue churn rate

While customer churn rate tells you how many customers you’ve lost, revenue churn rate — often linked to monthly recurring revenue (MRR) — shows the financial impact of that loss. Revenue churn measures how much revenue is lost due to customer churn or subscription downgrades. This metric is especially useful in subscription-based models where not all customers contribute equally to revenue.

Here is a simple formula:

Example: Suppose you have a subscription business of 100 customers. 90 customers (Pool A) pay a $1 subscription fee and 10 customers (Pool B) pay a $100 subscription fee.

Your MRR is (90x1) + (10x100) = $1090

Now, consider the below scenarios:

1️⃣ You lose 10 customers from Pool A

In this case, the customer churn rate would be 10% and the revenue churn rate would be 0.91%.

Let us see how:

Customer churn rate = (10/100) x 100 = 10%

Revenue churn rate = (10/1090) x 100 ≈ 0.917%

2️⃣ You lose 1 customer from Pool B

In this case, the customer churn rate would be 1% and the revenue churn rate would be 9.17%. Let's see how.

Customer churn rate = (1/100) x 100 = 1%

Revenue churn rate = (100/1090) x 100 = 9.17%

Here, a 1% customer churn results in a significant revenue impact (9.17%) because you lost a high-value customer.

The key advantage of tracking revenue churn is that it gives you deeper insight into how churn affects your bottom line, especially across different customer segments. High-value customers typically have a larger impact on revenue, even if the customer churn rate seems small. Understanding both metrics together helps you prioritize efforts to retain customers who matter most.

Importance of tracking customer churn rate

It is more cost-effective to retain existing customers than to acquire new ones. For instance, acquisition costs are 4 to 5 times higher in the SaaS industry than retention costs. So, to maintain business health, you must proactively track customer churn rates. Here are a few key reasons why monitoring churn is crucial:

1. Gauge customer sentiment

Tracking customer churn provides valuable insights into customer behavior and satisfaction with your product or service. You can identify patterns and better understand customer sentiment by analyzing churn data. Tools like cohort analysis, which groups customers by segments, demographics, or other shared characteristics, can offer deeper insights into why certain customers churn. With this information, you can create targeted customer retention strategies to address the root causes of churn.

2. Refine product and service offerings

Consistent churn tracking can help you pinpoint quality or service issues that may be driving customers away. When combined with customer feedback, churn data offers a comprehensive view of where your product or service may fall short. This allows you to make targeted improvements, ensuring you meet or exceed customer expectations — ultimately reducing churn.

3. Gain competitive advantage

When your customers churn, they may be moving to a competitor. By actively monitoring churn, you can mitigate the risk of losing customers to rival companies. Additionally, staying informed about your competitors' products, pricing and marketing strategies helps you anticipate potential churn triggers and respond with proactive retention measures.

How to calculate different types of churn rates?

1. The simple method

Formula:

Example: If the customers at the start of the month are 1000 and the churned customers are 50, the churn rate is (50/1000) x 100 = 5%.

Why it works: This method is quick and easy to calculate, making it ideal for comparing churn rates month-over-month. It’s especially suitable for companies whose customer base remains relatively stable over time.

Limitations: The simple method doesn’t account for customer growth or fluctuations during the period, making it less precise. For example, if you acquired many new customers during the month, this calculation wouldn’t reflect that growth — giving you an incomplete picture.

For instance:

Parameters | January | February |

Customers at start | 1000 | 1200 |

Customers lost | 50 | 60 |

Churn rate | 5% | 5% |

The churn rate here remains unchanged for both months; however, the business lost more customers in February. Situations like these make this method unreliable.

2. The adjusted method

The adjusted churn rate considers values at the start and end of the period, considering new customers gained during the period.

Formula:

Example:

Parameters | January | February |

Customers at start | 1000 | 1200 |

Customers at end | 950 | 1150 |

Customers Lost | 50 | 50 |

Calculation:

Parameters | January | February |

Average number of customers | (1000+950)/2 = 975 | (1200+1150)/2 = 1175 |

Adjusted churn rate (decimal) | (50/975) = 0.05128 | (50/1175) = 0.0425 |

Churn rate (%) | 5.128% | 4.25% |

Why it works: This method gives a more nuanced and accurate view of the churn rate than the simple method.

Limitations: It does not consider the fluctuations in customer numbers during the period. This can hinder businesses with seasonal fluctuations or where customer retention and acquisition strategies frequently change.

3. Predictive churn rate method

The predictive churn rate method uses historical data to forecast future churn trends, leveraging advanced analytics and machine learning. This approach enables you to anticipate customer attrition before it happens, allowing for proactive interventions. There are two key steps involved:

1. Data collection:

Gather historical data on customer behavior, usage patterns, customer satisfaction (CSAT) scores and other relevant metrics.

2. Build predictive models:

Utilize advanced analytical techniques and machine learning algorithms to build models that detect patterns in customer behavior. These models can help identify at-risk customers and calculate projected churn rates.

Example:

A predictive model may identify that customers with low engagement levels and CSAT scores are likely to churn. Based on this data, the model might predict a 10% churn rate within that specific customer segment.

Why it works: Predictive churn models allow you to take preventive action by forecasting which customers will likely leave. This makes your business better equipped to handle potential churn crises before they occur.

Limitations: This method relies heavily on the availability of historical data, which may not always be comprehensive or up-to-date. Additionally, past trends don’t always accurately reflect future market conditions, making continually refining predictive models important.

4. Shopify method

In the Shopify method, customer churn is calculated by dividing the number of customers churned by the average customer count for each day of the month. This method offers a more accurate churn rate than the start and end customer numbers.

Formula:

Note: Average no. of customers = (Sum of customers for each day in the period/No. of days in the period)

Step-by-step calculation:

- Calculate the total number of customers who churned in a given period.

- Record the customer count for each day during the period.

- Compute the average number of customers over the period.

- Divide the number of churned customers by the average number for that period.

Example:

- Churned customers = 115

- Number of days in a month = 30

- Daily customer count (shared in the table below):

Day 1 | Day 2 | Day 3 | Day 4 | Day 5 | Day 6 |

Day 7 | Day 8 | Day 9 | Day 10 | Day 11 | Day 12 |

Day 13 | Day 14 | Day 15 | Day 16 | Day 17 | Day 18 |

Day 19 | Day 20 | Day 21 | Day 22 | Day 23 | Day 24 |

Day 25 | Day 26 | Day 27 | Day 28 | Day 29 | Day 30 |

Step 1: Calculate the sum of daily customers.

Summation = 980 + 985 + ... + 865 = 28,080

Step 2: Find the average number of customers for the month.

Average customers = Sum of daily customers / Number of days = 28,080 / 30 = 936

Step 3: Apply the churn rate formula.

Churn rate = (115 / 936) * 100 ≈ 12.28%

Why it works: More accurate than simpler methods, as it accounts for daily customer fluctuations.

Limitations: Slightly more complex to compute, requiring daily customer counts.

Average churn rate for industries

Knowing the average churn rate for your industry is important. It allows you to compare your customer retention efforts against competitors, refine your strategies and provide investors with crucial insights into your business's growth and health.

Not just that, understanding industry churn rates is essential for businesses for several reasons:

📈Benchmarking performance: Compare your churn rate to industry standards to set improvement goals.

🚩Identify red flags: A higher churn rate than your industry average may indicate an issue with your product or service.

🔭 Discover new opportunities: High churn in your industry might mean an opportunity to improve customer retention and differentiate yourself.

🧮 Strategic planning: Use industry averages to set practical targets for churn reduction and guide decisions on marketing customer service and product development.

💵 Investor relations and growth metrics: Stakeholders will assess your business health by comparing your churn rate with the industry average.

↪️ Manage risks: Understand your industry's stability and market dynamics and plan your customer retention strategies accordingly.

Paddle reports that in the SaaS sector, the average churn rate is approximately 5%, with a churn rate of 3% or lower deemed "good." However, this can vary significantly between different businesses and industries, meaning there isn't a one-size-fits-all "average" churn rate. The following table outlines the average churn rates across various industries.

Industries | Churn rate |

Financial/Credit | 25% |

Cable | 25% |

General retail | 24% |

Online retail | 22% |

Telecom/Wireless | 21% |

Travel | 18% |

Big box electronics | 11% |

7 Tips to reduce churn rate

1. Understand and analyze customer feedback

Analyzing customer feedback data is one of the most powerful tools for reducing churn and boosting customer satisfaction. By systematically collecting and reviewing feedback through channels like surveys, social media, reviews and direct customer interactions, you can gain valuable insights into what customers love and where they experience friction. This helps identify pain points and uncovers emerging trends and unmet needs.

When you act on this feedback, whether it’s resolving issues or improving services, you send a clear message to your customers that you’re listening and willing to evolve. This responsiveness fosters customer loyalty, strengthens relationships and positions your brand as customer-centric—key factors in reducing churn, especially in competitive industries.

😊 Good to know

Advanced survey software, powered by Generative AI and verticalized AI models, offers more than just basic surveys. It provides fully automated, actionable insights with clear explanations of customer behavior drivers. These tools are proactive in detecting emerging trends and unknown customer experience drivers, helping you to stay ahead of potential churn with minimal setup.

Moreover, these platforms give you a comprehensive 360° view of customer feedback by combining survey responses with data from social media, review sites and service interactions. By comparing survey results with other feedback sources, you can validate insights quickly and accurately, empowering you to make more informed decisions to reduce churn and enhance customer loyalty.

2. Use social listening to help your customers proactively

Negative word-of-mouth can spread rapidly, especially through social media, where customers often express their emotions — both good and bad — about their experiences with a brand. This can directly impact customer retention, as a single viral complaint may prevent future prospects from converting or even trigger current customers to leave.

That’s where social listening becomes essential. By monitoring social channels, you can gain valuable insights into customer sentiment and identify potential churn signals early on. Whether it’s a frustrated tweet or a negative review, social listening allows you to take proactive action, address concerns and even reimagine your customer engagement strategies before customer dissatisfaction snowballs into lost business.

Read More: Top 10 Social Listening Tools in 2024

3. Deliver outstanding customer service

In an era where instant gratification is the norm, consumers expect swift responses on their preferred channels. According to CX statistics, 40% of customers want replies on social media within an hour and 79% expect a response within 24 hours. However, only about 50% of businesses meet these expectations, creating a significant opportunity for those who can excel in customer service.

Providing exemplary customer service can be your competitive edge in a crowded market with similar offerings. Training your team to deliver personalized, responsive support not only enhances customer satisfaction but also strengthens customer connection. Each interaction is a chance to build loyalty and foster a sense of belonging, which is crucial for retaining customers over the long term.

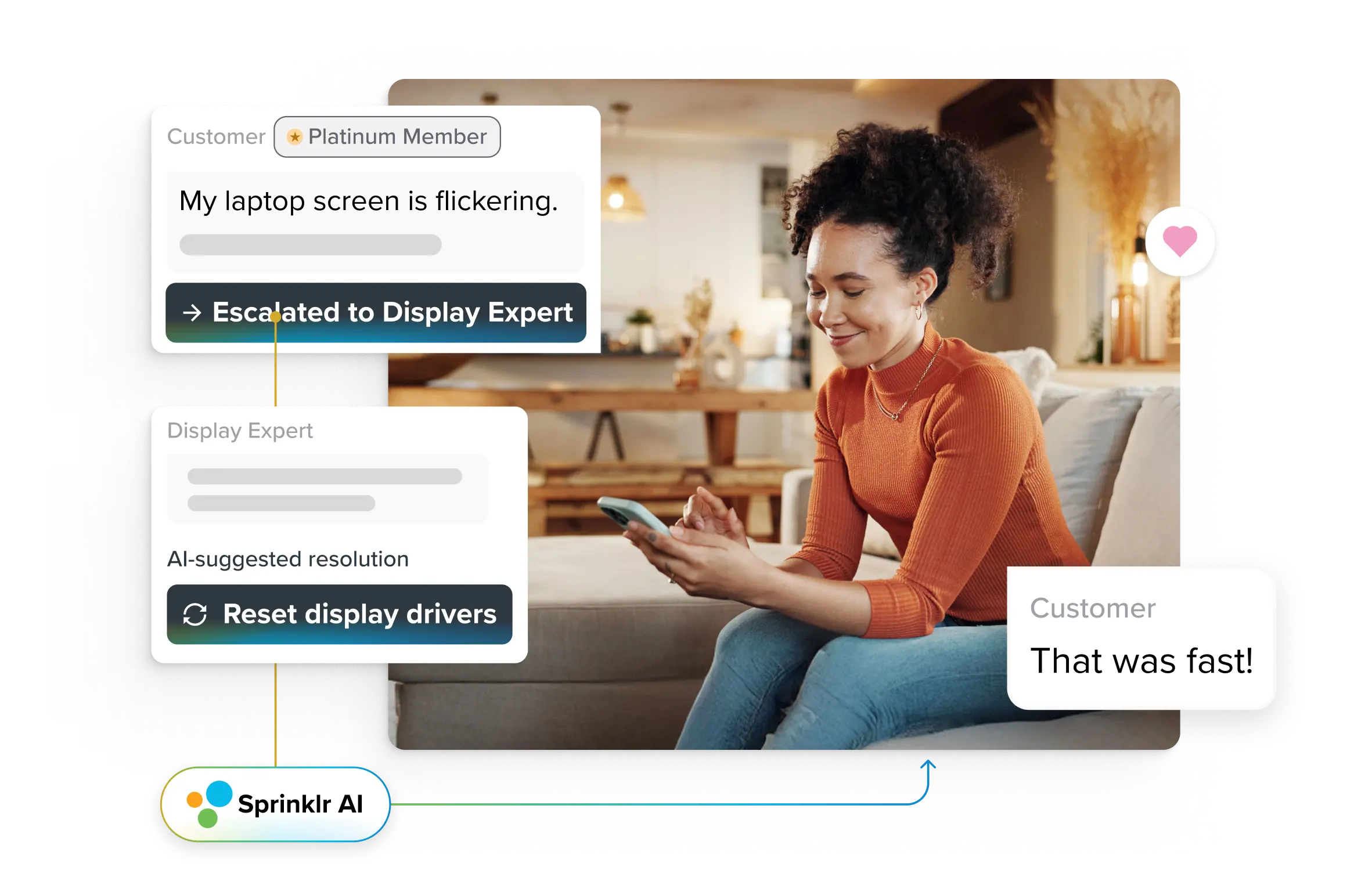

How Sprinklr helps

To elevate your customer service to new heights, Sprinklr Service offers AI-powered customer intelligence that understands customer intent and predicts potential issues before they arise. By leveraging Sprinklr AI, you can anticipate customer needs and engage proactively across 30+ channels, ensuring no inquiry goes unanswered.

By integrating Sprinklr into your customer service strategy, you empower your team to create exceptional experiences that keep customers coming back.

4. Improve post-purchase journey

A seamless customer onboarding experience and meaningful engagement post-purchase are crucial for reducing churn. When customers feel supported and valued after purchasing, they are more likely to adopt and utilize your product or service thoroughly.

To achieve this, consider offering exceptional post-purchase support. This could include a comprehensive knowledge base that addresses common questions and challenges and assigning a dedicated account manager to guide customers through their journey. These efforts significantly accelerate the time to value, helping customers see the benefits of your offerings more quickly.

By investing in post-purchase engagement, you not only enhance customer morale but also increase the likelihood of renewals. When customers know they have support at every step, they are more likely to remain loyal to your brand and less likely to churn.

5. Incentivize brand loyalty

Creating a rewards program that offers loyal customers points and exclusive benefits is an effective strategy for encouraging repeat purchases and fostering a sense of appreciation. When customers feel valued, they are more likely to return and make additional purchases.

Incentives motivate customers to stay engaged and help build emotional connections with your brand. These connections can transform satisfied customers into passionate brand advocates who share their positive experiences with others. As a result, this strategy significantly reduces customer churn by reinforcing positive interactions and encouraging word-of-mouth referrals.

📔 Ultimate Blueprint: How to start a customer loyalty program

6. Offer omnichannel support

Omnichannel support unifies all customer interactions across channels. Customers can reach out on their preferred platform—whether it’s social media while on the go, email when they have more time, or live chat for quick questions—and the conversation seamlessly carries over. There is no need to re-explain their issue; omnichannel systems ensure all previous interactions are tracked and accessible to agents, making the customer feel heard and valued.

Let’s take a practical example: Imagine a customer experiencing issues with an online service. They start a conversation on live chat but cannot resolve it during their lunch break. Later that day, they switch to social media to continue the dialogue and the support team picks up where the chat left off. The following day, the customer received a proactive email update confirming that the issue was resolved. This fluidity builds confidence in the brand’s customer service.

This kind of omnichannel support offers a significant competitive edge over companies that rely on siloed systems. Brands that don’t provide omnichannel customer service often lose customers because of repeated frustrations and the burden of switching between disconnected platforms. Empowering customers to reach out as often as needed on their preferred customer service channels and ensuring their concerns are always met with continuity builds stronger customer loyalty and reduces churn.

7. Conduct customer meetups

In an increasingly digital world, personal connections are more valuable than ever. Conducting customer meetups — whether virtual or in-person — offers a unique opportunity to build stronger relationships with your customers. These meetups allow you to engage directly with your audience, address their concerns and gain firsthand insights into their experiences with your products or services. Customers appreciate being heard and meetups show you’re invested in their success.

Meetups can also function as a platform for peer-to-peer interaction. Customers can exchange best practices, share how they’re using your product innovatively and create a sense of community around your brand. This community-driven approach is an excellent way to reduce churn, as customers who feel connected to a brand and its user base are more likely to stay engaged.

Learn How to Start a Successful Brand Community (with Pro Tips)

Don’t just measure customer churn; track these metrics

When analyzing customer churn, it's essential to broaden your focus beyond just churn rates. To gain deeper insights into customer behavior and improve retention, track these additional key metrics too:

1. Monthly recurring revenue (MRR) churn rate: MRR represents the total recurring revenue from all subscription sources within a given month. Tracking the MRR churn rate helps you understand how much revenue is lost due to customer cancellations or downgrades. By identifying patterns in MRR churn, you can pinpoint which customer segments or behaviors are contributing to lost revenue and take targeted actions to reduce it.

Why it matters: Unlike customer churn, which measures the number of customers lost, MRR churn reveals the financial impact of that churn, providing a more nuanced view of how cancellations are affecting your business.

2. Reactivation MRR and reactivation rate: These metrics assess how successful you are in re-engaging churned customers. Reactivation MRR shows the total revenue regained from customers who had previously canceled, while the reactivation rate measures the percentage of churned customers who returned during a specific period. A high reactivation rate indicates that your customer retention strategies — such as win-back campaigns or special offers — are effectively reconnecting with former customers. Conversely, a low rate signals the need to reassess your approach.

Why it matters: Reactivation metrics are valuable indicators of how well your business can mend broken relationships with customers. The ability to regain lost customers is often more cost-effective than acquiring new ones, making these metrics vital for sustainable growth and churn reduction.

Why Sprinklr is your best bet to reduce churn rate

Customers churn for many reasons — unmet expectations, lack of personalized support or fragmented service experiences. However, what often drives them away isn’t the product itself but poor customer service, unresponsiveness and a lack of meaningful engagement.

When customer service falls short, customers are quick to explore alternatives. A significant percentage of churn occurs because customers feel undervalued or unassisted when they need it most. This is where exceptional customer service becomes your most powerful defense against churn.

Offering proactive, omnichannel support, personalized engagement and consistent communication can delight customers and build loyalty. Well-supported customers are far less likely to churn and far more likely to become brand advocates.

Sprinklr empowers your team to deliver the service that retains customers and reduces churn. The AI-native solution helps you understand customer intent, predict potential issues before they escalate and provide proactive support across 30+ channels. To know how it works, schedule a demo of Sprinklr Service today!

Frequently Asked Questions

Yes, a low churn rate signifies that customers are satisfied, which can reflect positive business growth.

A lower churn rate generally means that customers stay longer with the brand, which increases the business's lifetime value.

Easy and effective onboarding can help your customers quickly understand the features and benefits of your product/service, lowering the chance of them leaving early.

Brands can review customer feedback and analyze customer behavior patterns. The data can help them determine if customers left by will or due to unavoidable circumstances.

Yes, different industries may need different approaches. E.g., in a B2B scenario, tailored customer support might help a brand retain a customer. In B2C, it could be loyalty points or aggressive discounts.