The AI-first unified platform for front-office teams

Consolidate listening and insights, social media management, campaign lifecycle management and customer service in one unified platform.

Role of Conversational AI in Insurance

In the six-trillion-dollar insurance market, economic uncertainty and the commoditization of insurance have heightened consumer price sensitivity. Beyond acquisition challenges, insurers grapple with retaining customers, ensuring profitability and delivering consistent customer experiences.

The daily influx of customer interactions, from inquiries to claims and payments, necessitates a strategic approach and realizing the transformative potential the insurance industry has embedded conversational AI in their technology stack.

Today, conversational AI in the insurance sector empowers insurers to provide personalized experiences, enhance operational agility, and reduce costs. However, it’s essential to understand that it’s not just about adopting the technology; conversational AI in insurance must be tailored to suit your unique business needs. And often, companies struggle as they don’t know where to start.

In this blog, we delve into the definition of conversational AI, key benefits, use cases and a step-by-step guide on implementation.

What is conversational AI?

Conversational AI empowers virtual agents and chatbots to engage in live conversations with human-like understanding and responses. It uses natural language processing and machine learning to understand user input and generate relevant responses that closely mimic human communication.

It automates routine tasks, handles redundant inquiries and guides customers through processes, alleviating monotony for agents and improving agent productivity.

In the insurance industry, known for daily high call volumes, conversational AI has become indispensable, allowing customers to seamlessly self-serve rather than endure wait times in queues to connect with live agents. This addresses the challenge of reducing average handle time and significantly enhances customer service by providing instant access and solutions.

Benefits of conversational AI in insurance industry

Regardless of your products and services, customers expect access to your customer service team across various contact center channels while enjoying the same personalized experience they've come to appreciate in other industries. This is precisely what conversational AI helps you deliver in the insurance sector — redefining how you interact with customers and optimizing your workflow management.

1. 24x7 personalized support

Delivering personalized support around the clock is a fundamental challenge for insurers and maintaining a 24x7 customer service team can be costly and operationally challenging, especially globally. The complexities of recruiting agents, workforce management, and call center forecasting become daunting as you expand. Conversational AI emerges as a solution that addresses these challenges head-on, providing the insurance sector with the consistent and error-free assistance it demands.

2. Efficient underwriting process

Traditionally, underwriting has been a time-consuming task for the insurance sector. Conversational AI in insurance facilitates seamless communication with applicants, extracting necessary information for risk assessment without requiring live agent involvement. This expedites the underwriting cycle and enhances accuracy by minimizing manual errors. Moreover, conversational AI goes beyond mere data collection. It can employ sentiment analysis to discern the customer's intentions and propose personalized policies with minimal risk for the insurer and the insured.

3. Easy claim settlement

The traditionally time-consuming claim settlement process, often bogged down by extensive document verification from police reports to medical documentation, is no longer an inevitable delay.

Today, customers can raise the nature of the claim and leveraging conversational AI, intelligent virtual agents can fetch policy details from contact center CRM, assess damage using advanced image processing, forecasting and predictive capabilities, verify documents and initiate the claims process. This enhances customer satisfaction and optimizes the claims management workflow for insurers and policyholders alike.

How Sprinklr AI helps:

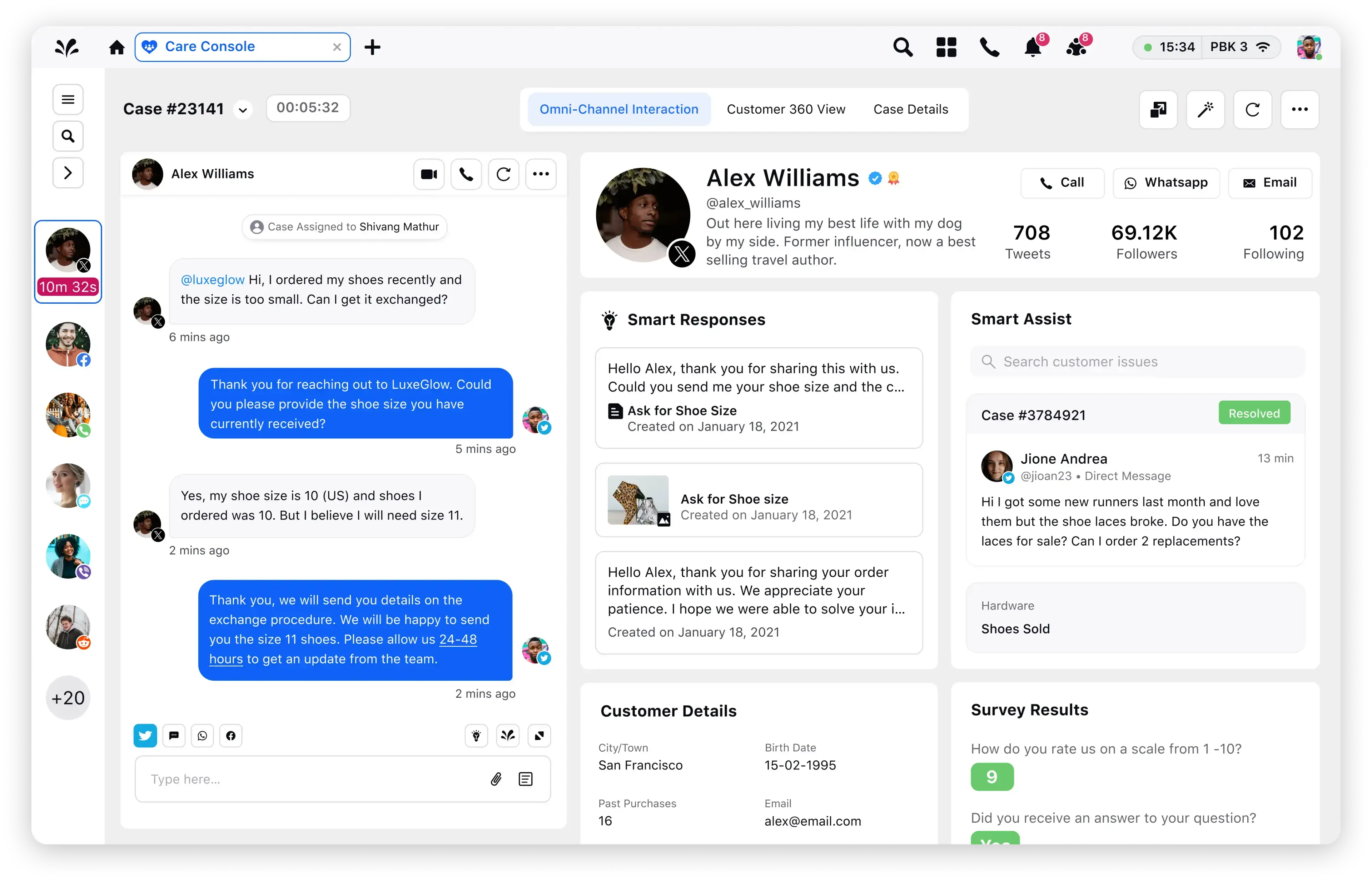

When a customer seeks assistance from live agents, modern conversational AI software takes a step beyond, effortlessly summarizing the entire chat history into a concise format. No more sifting through lengthy conversations for your agents. As they manage the nitty-gritty, Sprinklr AI+ delivers live, on-call recommendations from similar cases. This accelerates both your agents' decision-making process and claim management, ensuring a streamlined and efficient workflow.

4. Increased operational efficiency

Automating routine tasks, such as processing policy inquiries and handling standard claims, liberates staff from repetitive duties. This empowers insurance professionals to redirect their attention to intricate tasks, like complex claim assessments or personalized customer interactions.

5. Compliance and accuracy

Conversational AI ensures meticulous adherence to regulatory standards in the insurance sector, minimizing the risk of human errors during customer interactions. This guarantees compliance with industry guidelines and enhances the accuracy and reliability of information, fostering trust and confidence among policyholders.

Suggested read: Contact Center Compliance: Importance, Strategy & Checklist

6. Multilingual support

Expanding globally but aiming to dodge the headache of hiring support agents worldwide? You're in luck! Conversational AI in the insurance sector extends its reach by offering seamless communication in multiple languages. You can engage with a broader audience by breaking language barriers and ensuring personalized and effective interactions anytime, anywhere.

7. Reduced costs

Small insurance businesses and start-ups achieve substantial cost savings and improve contact center ROI with conversational AI. By automating customer interactions and routine processes, it does the heavy lifting without putting a strain on your budget.

Bonus read: 8 Reasons Why Conversational AI Chatbots Are the Ultimate Customer Care Problem-Solvers

How to implement conversational AI in an insurance company

Implementing conversational AI in an insurance company involves collaboration among IT departments for technical integration, data scientists for training the AI model and customer service teams for insights into customer needs. Here is a step-by-step guide to embed conversational AI into your communication stack.

Step 1: Define objectives and use cases

Begin by identifying the specific pain points within your insurance operations that conversational AI can address.

For example, consider objectives such as improving claims processing efficiency, enhancing customer engagement, or improving response times in customer support. Use cases could involve automating routine inquiries, guiding customers through policy details or facilitating first-level claims assessments.

Step 2: Understand your customer base

In the insurance sector, understanding your customer base is paramount due to the diverse nature of policyholders.

For example, if your customer base consists of a significant portion of younger, tech-savvy individuals, consider implementing conversational AI through digital customer service channels such as mobile apps or chat platforms. For an older demographic, ensure compatibility with traditional channels like phone calls.

Good to know: With the advanced omnichannel routing software, you can create an omnichannel routing logic to cross-utilize agents across voice and digital channels, increasing their utilization without creating channel-specific configurations. Know how omnichannel routing works.

Step 3: Choose the right technology partner

Select a reliable technology partner specializing in Conversational AI for the insurance industry. Ensure they have experience deploying solutions similar to your use cases and can provide the necessary support and customization.

A story worth telling: Finance & Insurance Brand Tackles a 110% Surge in Messages with the Power of AI

Step 4: Data integration and security

Establishing seamless connectivity between the conversational AI system and your existing data infrastructure is critical. This involves linking the AI platform to your database housing customer profiles, policy details and historical interactions.

Similarly, encryption techniques, secure data transmission and access controls are crucial components. Prioritize security certifications and adhere to call center best practices to mitigate the risk of data breaches or unauthorized access.

Step 5: Train and fine-tune the system

Training and fine-tuning conversational AI in the insurance sector involve imparting industry-specific knowledge to the system and continually refining its capabilities to optimize customer journeys. You should analyze user interactions regularly to identify patterns, conversational gaps, triggers, hand-off options and areas of improvement. Periodically update the training data to reflect evolving customer needs and changes in industry practices, ensuring that the AI remains aligned with current trends.

Pro Tip: Natural language processing platforms typically include features for reporting and training. This functionality allows you to analyze the terms and phrases users input into the conversational AI.

Evaluate whether user questions align correctly with the chatbot dialogs, identifying instances where the chatbot fails to produce a valid response. Utilizing this information, you can enhance and fine-tune your chatbot's conversational capabilities, ensuring a more accurate and responsive interaction with users.

Step 6: Test rigorously

Engage diverse users to test your conversational AI platform rigorously. Confirm that the chatbot effectively guides users to the intended information. Document instances where conversations break down, particularly when users input unexpected queries or expressions that the chatbot did not anticipate.

Step 7: Pilot program

Roll out a pilot program to a limited audience or specific use cases. Monitor performance, collect feedback and make necessary adjustments before a full-scale deployment.

Step 8: Full-scale deployment and continuous monitoring

Upon successful pilot results, proceed with a full-scale deployment. Implement continuous monitoring to track performance, user satisfaction and system efficiency. Regularly update the AI to adapt to evolving customer needs and technological advancements.

Editor’s pick: Demystifying Conversational AI: Best Practices for Building Efficient Chatbots

Use cases of conversational AI for the insurance sector

Read on to learn the typical use cases in an insurance contact center and how conversational AI simplifies the customer journey.

💵Use case 1: Claims processing

Challenge: Lengthy and complex claims processing, leading to delays and angry customers.

How conversational AI helps: Automates initial claims steps, allowing users to initiate claims, provide information and receive real-time updates.

📄Use case 2: Policy inquiries

Challenge: Customer confusion and time-consuming processes for policy-related queries.

How conversational AI helps: Enables customer self-service regarding queries, coverage details and premium calculations through natural language processing.

🎧Use case 3: Customer support

Challenge: Limited availability of human agents for 24/7 support, leading to longer average hold times and delays in addressing customer inquiries.

How conversational AI helps: Provides constant customer support through conversational AI for routine inquiries, ensuring consistent and timely assistance.

Example: A customer seeks help at midnight owing to a failed payment and the chatbot promptly addresses the inquiry, offering information and assistance without human intervention.

Must Read: Customer Support vs. Customer Service: What Is the Difference?

🔔Use case 4: Renewal reminders

Challenge: Inadequate communication for policy renewals, leading to missed deadlines and lapses in coverage.

How conversational AI helps: You can create a proactive customer service strategy by sending personalized renewal reminders regularly. Conversational AI in insurance can remind policyholders of renewal before seven days, 48 hours and 24 hours, prompting timely action and reducing the risk of policy lapses.

📟Use case 5: Risk assessment

Challenge: Limited insights into individual customer behaviors for personalized risk assessment.

How conversational AI helps: Utilizes sentiment analysis and conversational intelligence to assess customer risk profiles and customize insurance policies accordingly.

Example: A customer engages with the insurance chatbot, discussing recent travel plans and lifestyle choices. The chatbot, utilizing sentiment analysis, identifies the customer's cautious approach and responsible behavior. Based on this analysis, the insurer tailors a policy with personalized coverage, considering the customer's risk profile, ultimately fostering a sense of security and trust.

🌎Use case 6: Multilingual support

Challenge: Language barriers hinder effective communication with a diverse customer base.

How conversational AI helps: Breaks language barriers, offering seamless communication in multiple languages.

📝Use case 7: Underwriting process

Challenge: Time-consuming underwriting process with manual efforts and potential errors.

How conversational AI helps: Accelerates underwriting by extracting the necessary information from applicants accurately.

🕙Use case 8: Appointment scheduling

Challenge: Complex and time-consuming scheduling processes for insurance-related appointments.

How conversational AI helps: Facilitates easy appointment scheduling for policy consultations, claims assessments and personalized services.

Example: A policyholder must schedule a consultation with an insurance agent to discuss a policy update. Through the insurance chatbot, the customer initiates the scheduling process by specifying their preferred date and time. The chatbot, already integrated with the insurer's scheduling system, promptly confirms the appointment and sends a calendar invite.

👮Use case 9: Fraud detection

Challenge: Increasing instances of insurance fraud, leading to financial losses.

How conversational AI helps: Employs AI algorithms for fraud detection, analyzing patterns and anomalies in customer data and claims submissions.

Example: A customer submits a claim for a supposed accident with detailed information. The insurance chatbot, equipped with fraud detection algorithms, cross-references this claim with historical data, policy details and external databases. The chatbot identifies inconsistencies and flags the claim for further investigation. The insurer's fraud detection team reviews the flagged claim, uncovering a pattern of suspicious activities.

📖Use case 10: Customer education

Challenge: Limited customer understanding of insurance terms and policies.

How conversational AI helps: Educate customers through conversational AI on insurance terms, coverage options and policy details.

Go beyond policies and claims handling with Sprinklr Service

The need for a transformative solution becomes evident as you face challenges daily, from cumbersome claims processing to intricate policy inquiries. However, to fully harness the potential of conversational AI, a change in mindset is essential. It's not merely about you as an insurance company dabbling in technology but adopting the mindset of a technology company within the insurance domain.

Positioning yourself in this forward-thinking category is where Sprinklr Service becomes your strategic ally, placing customers at the core of every interaction. Here's how:

- Channel agnosticism: Stay indifferent to channels and provide round-the-clock assistance with the Sprinklr AI+ powered conversational analytics platform.

- Intent capture across channels: Seamlessly capture customer intents and messages across 30+ channels, directing them to the appropriate agent for a personalized follow-up.

- AI-powered self-service: Elevate your service distinction by offering AI-powered self-service options, setting your offerings apart in a crowded market.

To explore Sprinklr Service, schedule a demo with our experts today. If the demo is not your cup of tea, dive into a no-strings-attached 30-Day Free Trial today!

Frequently Asked Questions

Yes, conversational AI is designed for seamless integration with existing insurance systems, ensuring compatibility with diverse technologies and facilitating a smooth transition into the current operational framework.

Absolutely, conversational AI plays a crucial role in fraud prevention by leveraging advanced algorithms to analyze patterns, anomalies, and inconsistencies in customer data and claims submissions, enabling early detection and mitigation of fraudulent activities.

Yes, conversational AI is adaptable and scalable, making it suitable for both large and small insurance companies. It caters to the specific needs of each, offering personalized customer interactions, operational efficiency, and cost savings regardless of the scale of operations.