The next generation of CCaaS is here

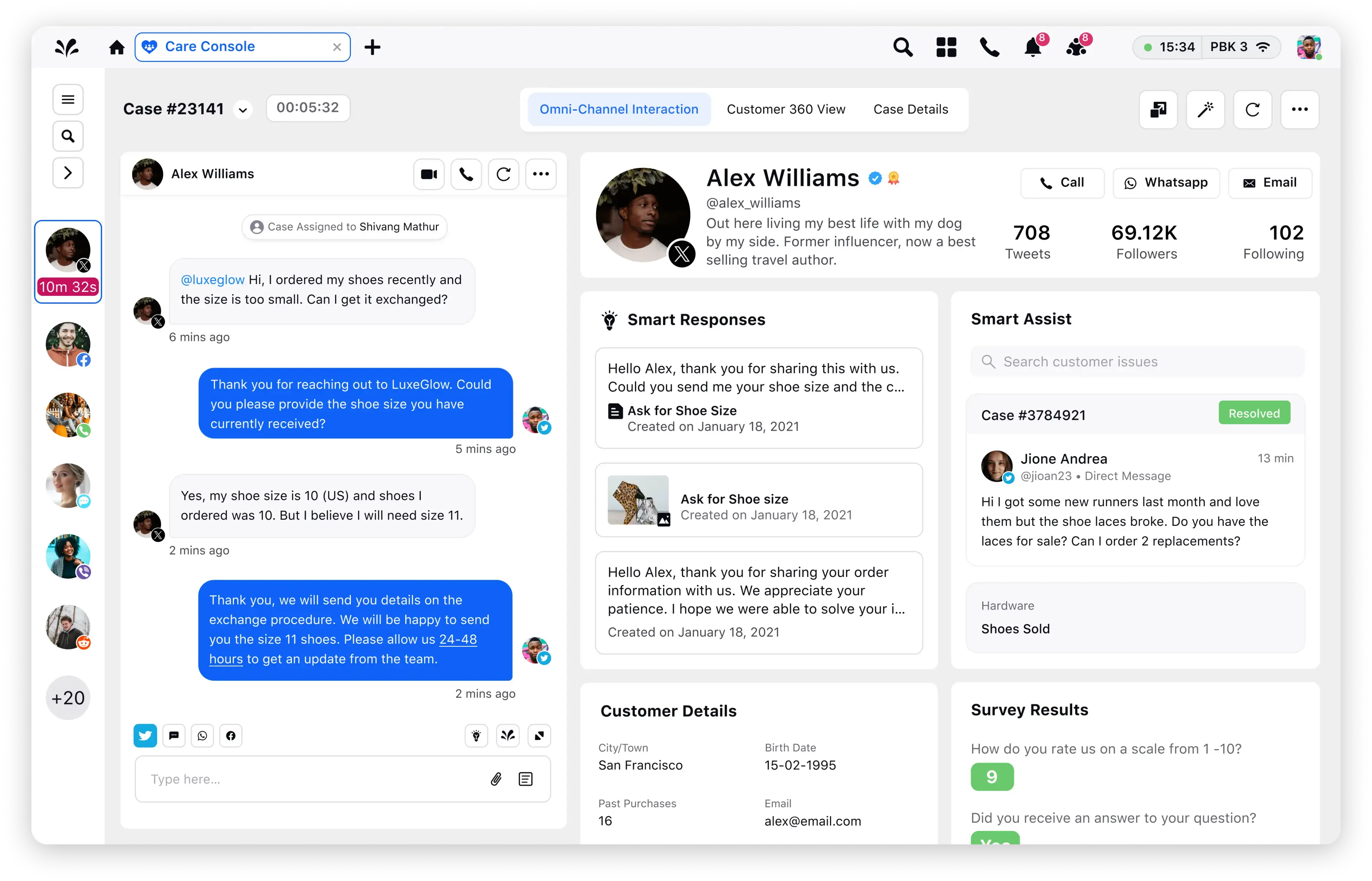

Digital-first customer service, enterprise-scale voice support. Redefine customer service with an AI-powered platform that unifies voice, digital and social channels. Power channel-less interactions and seamless resolution no matter the channel of contact.

5 ways financial services can differentiate with customer service in 2023

Macroeconomic conditions have changed, and many businesses in the financial services industry are struggling to navigate today’s new customer service landscape. Changing customer expectations and stricter regulations leading to increased expenses have made it harder for banks and other financial institutions to retain and attract customers. High-quality customer service is the differentiator that can lead to increased customer loyalty and satisfaction, which can translate into long-term benefits for the institution. By helping build strong relationships with customers, a well-executed customer service strategy ensures that they have a positive experience with the company. This can help to retain and attract customers, and ultimately drive business success.

- Challenges of customer service in banks

- Why do you need customer service in financial services?

- 1. Financial customer service must be proactive

- 2. Customer service must be seamless across channels

- 3. Use conversational intelligence to scale your financial customer service

- 4. Personalized experiences are critical for improving banking customer service

- 5. Data privacy and protection should be a top priority

- Customer service tips for financial services institutions

Challenges of customer service in banks

Banks hold the unenviable position of being an integral part of people’s personal and professional milestones but with the caveat of living up to high expectations due to the sensitive nature of finances. A few common challenges that you could run into with customer service solutions in banks are:

- Feasibility of making interactions with every customer personal and human at scale while maintaining compliance and data privacy

- 360 degree view of service requests and customer interactions across channels spanning voice, email, SMS, and social media without incurring heavy cost

- Providing resolutions that meet customer expectations while identifying opportunities for upselling and cross selling

- Consistent and proactive 24X7, omnichannel support at scale.

Why do you need customer service in financial services?

Customer expectations have changed in today’s digital-first world and financial service institutions such as banks, brokerages, investment firms and lenders are no exception to this change. The call center plays a key role in helping financial services institutions keep up with shifting compliance requirements. Customers have also come to expect hyper-personalized, instant help and support experiences from banking andfinancial customer callcenters. This is not a challenge but an important opportunity for you to increase trust, reduce costs, and set yourself apart from the competition.

1. Financial customer service must be proactive

Customers want to be updated about changes or potential issues well before an issue actually occurs. To meet these expectations, financial institutions should adopt a customer-centric approach and enhance the customer experience with contextual banking. For example, 47% of customers want their financial institution to connect the dots for them between their income, expenses, and savings — providing proactive guidance to help them reach their financial goals.

Proactive customer service solutions in financial services can take many forms, including:

- Lead generation: send a popup if a customer has spent a predetermined amount of time on a credit card page, for example, and assign them to a virtual assistant or advisor

- Payment collections: notify customers prior to loan due dates to ensure timely payments and provide a frictionless way to pay back the installments

- Automatic alerts: notify customers about abnormal transactions or account activity, including possible fraudulent activity, high-risk transactions, different device login or location, etc.

2. Customer service must be seamless across channels

Customers today have access to an ever-expanding amount of digital channels. And just when you think you’ve gotten your organization up to speed, a new channel appears and gains popularity. Daunting as it may feel, it’s critical that you support your customers on all of their preferred channels. You must bring financial customer service to them, rather than force them to come to you.

Speed and simplicity are hallmarks of any good customer service solution for financial institutions. You should be able to add new channels in minutes, rather than days. Look for customer service platforms that unify the many types of channels including social, messaging, email, voice, SMS, and even Google and Apple reviews.

Try Sprinklr Service to streamline your customer service across voice, chat, SMS and chatbots.

3. Use conversational intelligence to scale your financial customer service

Customers expect quick resolutions to their issues. With every transfer, and every minute they wait on hold, they lose their patience — which ultimately results in a loss of goodwill that can impact not just your relationship with that person, but your capability to grow your customer base.

Among customers who have changed banks due to bad service, 80% said they could have been retained if their issue had been solved on their first contact with the bank. Conversational banking helps customers resolve issues much more quickly. It also gives banks access to critical data on customer goals, financial behavior, intentions, and desires — identifying opportunities to upsell or cross-sell and offer relevant advice.

Bots allow financial services customer service operations to scale, and offer instant resolutions for customers. Most customer queries range from informational to transactional, and many can be efficiently resolved by bots, including:

- Conversational FAQ bots: provide up-to-date information on current interest rates, mutual funds, SIPs, mortgages, annuities, small business loans, and more

- Conversational payment bots: chatbots that can handle transactional queries related to credit card payments, monthly bills, etc.

- Conversational booking bots: schedule virtual or in-person appointments with bank executives for a financial consultation

- Conversational renewal bots: policyholders can see if they are due or overdue, renew their coverage from home, and get virtual assistance and premium acknowledgment, all within a single transaction

4. Personalized experiences are critical for improving banking customer service

Personalized experiences are becoming a differentiator in the financial services sector. Improving customer services in banks boils down to making every customer feel like a King.

People increasingly want to have seamless, integrated experiences across all touchpoints — and they do not want to keep repeating themselves. Customers today expect agents to know all about their previous conversations, understand their personal financial goals, and give advice tailored to their circumstances.

Customers also now expect a full digital onboarding in a frictionless, secure environment. They do not like to wait and they expect to have human interactions even when they are sitting in front of a screen or on call with an agent, just as they would at a physical branch but without the effort and hassle. Financial offerings are very complex, so it’s extremely important that you provide enough guidance to help people when they’re selecting the right products for their financial needs.

5. Data privacy and protection should be a top priority

Customers are protective of their personal data and have concerns about the way their information is processed and used by banks. They want to know that any sensitive personal information they share over a conversation channel is protected. But 73% say they are willing to share more personal information if companies are transparent about how it will be used.

The right customer service software will mask personally identifiable information (PII) using PCI-compliant secure forms to mitigate data privacy risk (e.g., only showing the last four digits of credit cards, and masking policy numbers, account numbers, loan application numbers, etc.). It should also comply with data purging and data retention policies for financial institutions, deflect users from untrusted social channels to secure chats, and allow users to access a copy of uneditable chat transcripts for transparency.

As your financial institution looks for new ways to have meaningful conversations with customers in digital spaces, AI-powered technology and these tips can help facilitate those human connections. Here’s how.

Customer service tips for financial services institutions

Timely and tailor-made assistance on platforms where your customers are active can make or break your institution’s reputation. Without it your customers may fall prey to misinformation, annoyance with your services or disinterest in your brand. Here are a few ways to improve customer service in banks and financial establishments.

- There’s an unprecedented level of unstructured data available which can be used for hyper-personalization of customer service in financial services. Customers today expect to feel valued and personalized solutions go a long way in retention.

- Personalization is no longer a good to have but a must-have for financial institutions. Customers expect the contact center to know their history and intent. Pre-emptive measures as well as resolutions tailored to the customers’ preferences and needs or a well-timed cross-sell is bound to leave an impression of a trusted friend and not a corporation.

- Convenience is key and financial services customers demand instant response and resolution on the channels of their choice. It’s important to be present where your customers are and not wait for them to come to you.

- Customers need an assurance of trust from the financial institution and the digital transformation of the industry is going to be heavily influenced by data privacy and compliance

- The role of Artificial Intelligence (AI) can’t be ignored anymore. It has huge potential to make contact centers and platforms more effective and scalable. We have found that 66% of customers are open to trying out self-service. Chatbots and automation can ease the load on contact centers as well as reduce cost and increase agent productivity.

A good financial customer service platform allows your financial institution to be present on all digital channels your customers are present on and helps you resolve their service requests while providing a unified view of their activity.

Sprinklr Service offers enterprise-grade security and customer service compliance for financial services institutions. Find out how our unified contact center as a service (CCaaS) solution makes it easy to listen to and understand banking services customers. Filtering out the noise — routing all engageable and relevant conversations to the right agent and teams inside Sprinklr Service’s agent desktop is one of the platform’s many capabilities.