The undisputed leader in social media management

For over a decade, the world’s largest enterprises have trusted Sprinklr Social for its in-depth listening, unmatched channel coverage, enterprise-grade configurability and industry-defining AI.

8 Social Media Strategies for Banking to Drive Product Awareness

Imagine a customer scrolling through their social media feed and coming across a compelling post from your bank that highlights an innovative savings scheme with better interest rates. They then get intrigued by the profitable possibilities and decide to click through to learn more. This leads them to discover your unique offerings and invest.

That's effective social media product awareness in the banking sector in a nutshell. It makes your banking products and services shine so potential customers can’t help but be drawn to the light.

As consumer habits shift more towards online platforms, banks can meet their customers wherever they are. In fact, most banks are capitalizing on this opportunity as you read this. Reports indicate that an impressive 88% of banks are already on social media platforms to build relationships and get a strong return on investments. So, your bank can’t afford to lag a moment or dollar in an overwhelmingly digital-first sales environment.

Considering this, we've designed an essential guide to help your bank make the most of these platforms. We'll be exploring strategies that could, possibly, make your banking products the centerpiece in the public eye on social media through greater accessibility and engagement.

Understanding social media for banking

Social media marketing for banking involves using platforms like Facebook, LinkedIn and Instagram, among others, to interact with both current and potential customers to introduce new bank offerings, promote existing ones and foster personalized customer connections with them.

95% of banks are already using Facebook to meet customer expectations for business purposes. And what do customers expect? They want to find informative, engaging and actionable content about banking products online so they can make informed financial decisions. And if your bank wants to be their go-to finance solution, it needs to bring its products into the social media limelight and promote confidence in them.

Read More: Facebook Marketing Strategy: 7 Best Techniques for 2024

Do banks really need social media marketing?

In short, yes. Social media has impacted nearly every aspect of modern-day life, including banking. Many turn to social media to explore financial tips, get updates on new offerings, post their queries and more. So, banks definitely require social media marketing to stay relevant.

Here are a few trends to show you why your bank needs to have a strong social media presence:

- A study conducted in 2022 shows that 78% of adults in the United States prefer to bank through a mobile app or a website. What’s more, just 29% of Americans choose to bank in person.

- 95% of banks worldwide prefer using Facebook, 75% of them utilize LinkedIn and 62% are active on Instagram. Each platform serves a distinct purpose. Facebook is utilized to reach a broad audience, LinkedIn to connect with professionals and Instagram to engage with younger clientele. Banks are using these platforms to target specific groups with tailored product promotions.

Pro tip 💡: With a social listening tool, banks can enhance their social media marketing far beyond just advertising. These tools help monitor conversations, gauge customer sentiments and spot trends, enabling banks to tailor their communications and offerings more effectively. Active engagement and timely responses to feedback can elevate product awareness and deepen customer connections, boosting satisfaction and loyalty.

8 proven tactics for banks to elevate product awareness on social media

Considering how customer behavior has changed on social media and the purchasing landscape is pretty much digital, your bank must learn to use social media platforms for marketing. It’s the only way you can promote your products efficiently and make them stand out in today’s world.

Are you thinking, “How?” Well, here are eight proven tactics that can boost the awareness of your bank offerings and elevate customer engagement.

Tactic #1: Forge partnerships with influencers

Banks can significantly improve their product awareness on social media by partnering with influencers. These collaborations create authentic connections between banks and their customers.

With their big audiences and high engagement rates, influencers can propel banking products and services to a broader yet targeted customer base. By infusing an element of trust and relatability, they can make financial products more appealing to potential customers, addressing gaps that traditional bank marketing may miss.

For example: A bank can team up with top personal finance influencers to promote the benefits of a new savings account. The influencers can guide viewers through their own personal experiences. They can highlight the features of the new savings account and showcase how it provides banking convenience directly to mobile devices.

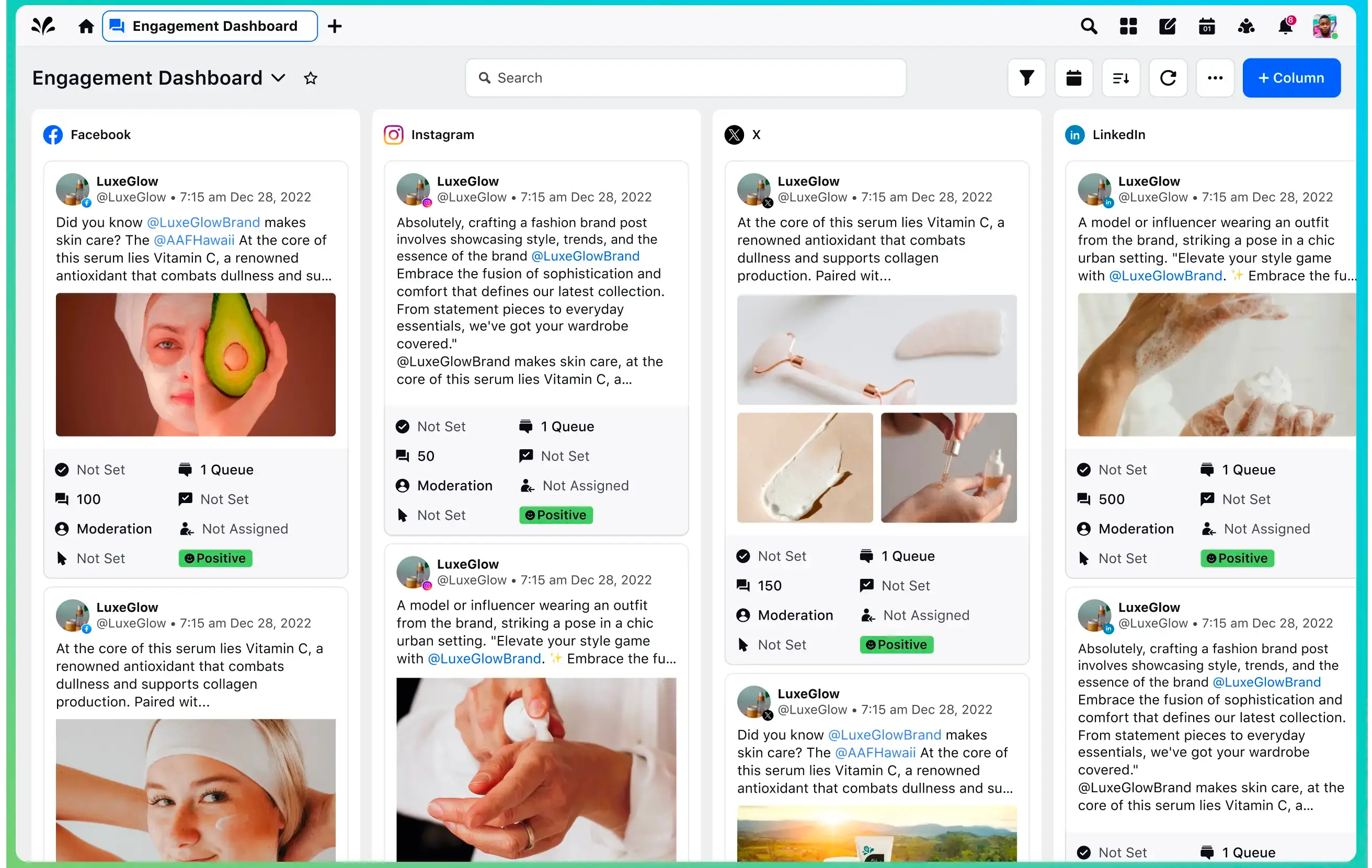

And if you’re wondering how exactly you can measure the impact of these partnerships, you can always use a consumer intelligence tool, like the one that’s been highlighted in the image below.

Pro tip 💡: Choose influencers whose values resonate with your bank's branding. This ensures that the partnership feels genuine to the audience, enhancing the credibility and appeal of your banking products.

Tactic #2: Craft precision-targeted ad campaigns

Banks can run hyper-targeted ad campaigns for their new offerings by using the detailed demographic and behavioral data available on social or third-party platforms. This will allow them to target their advertising efforts and reach the perfect customer profile at the right time.

Banks can significantly improve the relevance and effectiveness of their marketing initiatives by utilizing the rich data present on social media for accurate targeting. This results in higher conversion rates and elevated engagement.

For example: A bank could leverage a social advertising platform to effortlessly share home loan e-brochures across multiple social channels with users who have recently engaged with online content related to real estate purchases. This ensures that the message reaches individuals interested in buying a home.

Pro tip 💡: Continuously measure the performance of your ad campaigns and refine your targeting strategies accordingly. For instance, use A/B testing to identify the messages that appeal most to different segments of your target audience so you can refine your approach for better returns.

Tactic #3: Ignite conversations with hashtag campaigns

Creative hashtag campaigns can massively improve the reach and visibility of your banking products. Unique and memorable hashtags light up conversations on social platforms and elicit user-generated experiences around the campaign. This strategy boosts your product's digital footprint, building a community and fostering loyalty around your brand in the process.

For example: A bank introducing a new budgeting tool could utilize a hashtag like #SmartSavingsChallenge to encourage customers to save using that specific tool. Such campaigns can turn customers into brand advocates, who then generate organic awareness.

Pro tip 💡: Maximize the impact of your hashtag campaign by directly engaging with the participants through likes, comments and shares of their posts. It elevates the visibility of the campaign and calls for more involvement from your audience.

Tactic #4: Cultivate vibrant online communities

Another strategy that banks could use in fostering strong customer loyalty and engagement to promote their products would be to build online communities. This goes a long way in nurturing a sense of belonging in users. Banks can create spaces where customers can exchange ideas, share experiences and support each other. What’s more, these communities serve as valuable sources of advice or information, which further strengthens trust in the bank brand.

For example: The bank could launch a Facebook group designed for homebuyers. The participants in the group can engage in discussions about various types of mortgages, exchange tips on house hunting and seek financial advice from professionals in the industry. This can help customers make the right decisions, and it presents the bank as a cooperative and interactive financial partner.

Pro tip 💡: Keep your members engaged by posting interesting content, asking them questions and doing live Q&A sessions. This keeps the community lively and ensures members feel heard and valued, which strengthens their connection to your brand.

Tactic #5: Educate and engage with rich content

Establishing your bank as a thought leader and nurturing trust through educational content for your audience can make it easier for you to spread the word about your latest offerings. Whether you're conducting webinars on polarizing financial topics, posting educational videos or creating infographics, make it all easy to understand and engaging. This approach educates the customer and enhances the bank's reputation as a reliable source of financial information.

For example: A bank can come up with a series of short videos explaining the different types of savings accounts, smart investments or the basics of mortgage financing. This can help your customers make informed choices.

Pro tip 💡: Make the content relevant for your audience by speaking to their most common questions or concerns. Utilize customer feedback alongside search queries to identify the largest portion of your target demographic. Then, curate your content to address their requirements.

Tactic #6: Engage directly through interactive activities

Tools for engagement, such as polls and surveys, are powerful ways for banks to facilitate a two-way conversation with their audience. These means of interactive engagement provide useful insights into the preferences of customers. By asking for feedback and opinions, banks can make their customers feel heard and valued.

For example: A bank can use X (formerly Twitter) polls to ask its customers about the features they would like to see in a new banking application. This feedback can shape the bank's development strategy and make customers feel involved in the evolution of their banking experience.

Pro tip 💡: Combine the results of these engagements with actionable changes or responses. Showing your customers that their input has led to tangible improvements validates their participation and nourishes their connection to your brand.

Tactic #7: Showcase authenticity with user-generated content (UGC)

This is a way of encouraging customers to share their stories and experiences through testimonials, by which banks get to showcase the authentic voices of satisfied clients so potential customers become more inclined to your products. UGC enhances the credibility of your bank's marketing efforts because “real” experiences resonate more strongly with customers than traditional forms of advertisements.

For example: A bank can conduct a campaign on Instagram that encourages customers to post their success stories on how they managed to save money with a certain savings plan. This would showcase the most relatable content that potential customers can trust and demonstrate how the bank directly and positively impacted so many lives with its product.

Pro tip 💡: Expand the reach of UGC by featuring selected stories on your primary social media pages and website. Recognizing contributors by sharing their content validates their experience and encourages more customers to share their stories.

Tactic #8: Delight followers with exclusive offers

Special social media promotions can significantly boost engagement and awareness by rewarding followers with exclusive deals. This enhances loyalty to the bank's social media pages and encourages followers to take action. Such promotions can delight existing followers and also attract new ones. Viewers are encouraged to interact with the bank's social media profiles, anticipating rewards in the future.

For example: A bank could waive account fees for a limited time for customers who apply for a new account via a link provided on its social media channel. This strategy builds a sense of urgency and exclusivity, making people react right away.

Pro tip 💡: Amplify the power of your exclusive product offerings by using them as a special reward for your social media followers. This enhances the value associated with following your page, encouraging a loyal online community to further engage with your content and services.

Success stories: Leading banks on social media in 2024

Now that we’ve covered what banks need to get right in order to actively bring their offerings to center stage in the digital age. Here are a few pioneers who have excelled in using social media in 2024:

1. ICICI Bank, India — Pioneering non-banking services on social media

ICICI Bank has reinvented its customer engagement model by launching a non-banking Facebook app: the innovative Pockets tool, which is a comprehensive mobile wallet. The tool can perform banking activities that are not commonly offered by traditional banks such as paying friends and keeping track of group expenses. Additionally, it can directly access non-banking services, like mobile recharges and movie ticket bookings, via Facebook. This strategic move has increased financial interactions on the app and has notably elevated customer engagement levels.

2. Development Bank of Singapore (DBS) — Mastering engagement through contests

DBS has aced the approach of elevating engagement by leveraging words like "free," "travel," "voucher" and "prizes.” This allows the bank to effectively connect with Facebook users. The social media handle of the bank regularly hosts contests accompanied by calls to action such as "Like this page" or "Share this post.” This has dramatically increased the bank's brand reach and customer engagement.

3. Monzo Bank, England — Fostering a community spirit

Monzo, a leading "challenger bank" in the UK, has established itself as a frontrunner on social media through its unwavering focus on community engagement. The bank delivers tailored content to international travelers and backpackers on its page, showcasing its focus on building communities. The result? The page has become an attractive destination for distinctive, engaging and, often, amusing content. Not surprisingly, Monzo's social channels have experienced organic growth in their follower count: a stunning 600,000 across platforms.

Banks like Santander UK, M&T Bank, and Northwestern Mutual have fortified their social media presence through Sprinklr, which showcased the broader impact of advanced social media strategies and tools on BFSI customers. The Sprinklr suite also helped them to uphold compliance in the heavily regulated financial landscape. Here’s what happened:

- Santander UK, after adopting Sprinklr’s Unified-CXM platform, was able to break down silos between its customer care, marketing, compliance and social teams to act in unison on social media to deliver exceptional customer experiences while adhering to strict industry regulations. It also expanded its reach, engagements and customer pool exponentially.

- M&T Bank sought to communicate its vibrant culture and commitment to excellence through social media. After implementing Sprinklr Social and Sprinklr Insights, the bank was equipped to deploy a more comprehensive social media strategy that incorporated sophisticated reporting, employee advocacy and social listening.

- Northwestern Mutual wiped its Instagram feed clean to launch its one-of-a-kind “Museum of Recent History” campaign. By using Sprinklr’s Competitive Insights and Benchmarking tool, the company was able to assess what type of content clicked with its followers in the financial services industry. It also leveraged Sprinklr Social’s Asset Manager so the creative, social and compliance teams could coordinate content seamlessly to make it brand compliant and optimized for the platform.

Wrapping it up

Social media is here to stay. It has permeated nearly all aspects of our lives and all industries. So it just makes sense to leverage it to your advantage. And for that, you need a social media management tool to step in. A tool that’s designed to meet the unique social media needs of the banking sector in today's context.

As such, Sprinklr‘s suite of products offers AI-led advanced analytics on customer behavior, a unified dashboard and robust compliance tools. Simply put, it eliminates chaos. It also integrates with multiple social platforms to enhance efficiency and streamline banking processes. Wondering how exactly it can help unify your teams, tools and touchpoints?