The undisputed leader in social media management

For over a decade, the world’s largest enterprises have trusted Sprinklr Social for its in-depth listening, unmatched channel coverage, enterprise-grade configurability and industry-defining AI.

Social Selling in Financial Services

The financial services industry is undergoing a rapid and widespread digital transformation, where adopting a robust digital strategy is imperative. The entire BFSI sector is moving from pen and paper to tip-of-your-finger, impacting revenue and customer experience. Although customer servicing and lead generation are essential, staying compliant and mitigating risk is steadily becoming a top priority.

Investing in a social selling strategy is more important than ever to help your financial advisors engage clients across modern channels. The benefits are clear: new business growth, increased competitive advantage, and an improved customer experience across all touchpoints. Long relegated to the sidelines, social selling — also known as social media selling — is gaining widespread favor as brands realize its enormous potential.

Traditional methods are becoming less and less effective — and financial services companies that have embraced social selling are seeing phenomenal improvement in their business results. Despite an increasingly complex business environment, social selling can become an integral driver of success when implemented and managed properly. Take Northwestern Mutual as an example, they are one of the first financial services companies to offer compliant Instagram use across multiple advisors by leveraging AI via Sprinklr Distributed.

- Cracking the social selling code

- 1. Leverage technology and AI to make social selling more effective.

- 2. Invest in continuous training and development for your financial advisors.

- 3. Ensure Compliance and brand consistency with tools that increase visibility.

- 4. Use insights and data to optimize your social program continuously.

- 5. Strengthen your relationship with your customers

- Choose a social selling solution that maximizes reach and ensures compliance.

Cracking the social selling code

Social selling is connecting with prospects on social media platforms to affect sales. Sharing, commenting on, or even liking your prospects’ social media posts helps your brand connect with potential customers. Social selling requires a persistent effort to engage with your prospects and nurture them into customers.

There’s some overlap between social selling and social media marketing, but they are different. The fundamental difference is that social media marketing aids your marketing and branding goals, while social selling supports your sales and revenue generation activities.

Here are five ways financial services advisors can crack the social selling code to win in a competitive marketplace:

1. Leverage technology and AI to make social selling more effective.

The power of technology extends well beyond baseline tactics like URL shortening and suggestions about optimal post timing. When done well, social selling incorporates social listening to understand your audience's pain points, trending topics, influencers, and conversations that you can leverage to showcase your expertise and provide value. Financial advisors can leverage this information to start a conversation and build meaningful, long-lasting relationships.

2. Invest in continuous training and development for your financial advisors.

Many social selling tools have failed to generate adoption and engagement simply because the flow of knowledge and best practices did not continue well beyond onboarding. There are no shortcuts to success. Equip your sales teams to leverage technology and work smarter by sharing the latest updates, changes in features, and new trends from the digital world. Technology has made our lives easier. It can save precious time and resources if the proper information-sharing process is established as part of a formal social selling program.

3. Ensure Compliance and brand consistency with tools that increase visibility.

Monitoring what and how your advisors are engaging on social is vital. Empower your advisors by implementing a platform that facilitates communication within your organization. With a top-tier social selling solution, advisors can easily share pre-approved posts curated for them or customize messages handed off to a central team for approval before going out into the world. Advisors and corporate groups can feel confident that posts are on-brand and industry-compliant.

4. Use insights and data to optimize your social program continuously.

Social selling should concentrate less on sales pitches and more on sharing quality thought leadership content. A solution that combines data from multiple sources will give advisors a 360-degree view of the prospects and customers they’re interacting with, enabling them to have more meaningful interactions. With in-depth reporting and analytics, your advisors can quickly identify gaps and use clear, actionable insights to improve their content. Insights like sentiment analysis, the effectiveness of content, and sales activity will help advisors keep a pulse on their success and allow them to make adjustments where needed.

5. Strengthen your relationship with your customers

Your customers are the happiest when you know what they need, and that too at the right time. They feel more connected with the advisor when they can converse with them in their way, language, and the channel they prefer. With social selling, advisors can easily personalize the customer experience and gather real-time feedback.

Choose a social selling solution that maximizes reach and ensures compliance.

Social selling represents incredible team opportunities — but only when you have the right solution. When you’re searching for a tool that fits your needs, make sure you opt for a solution that has:

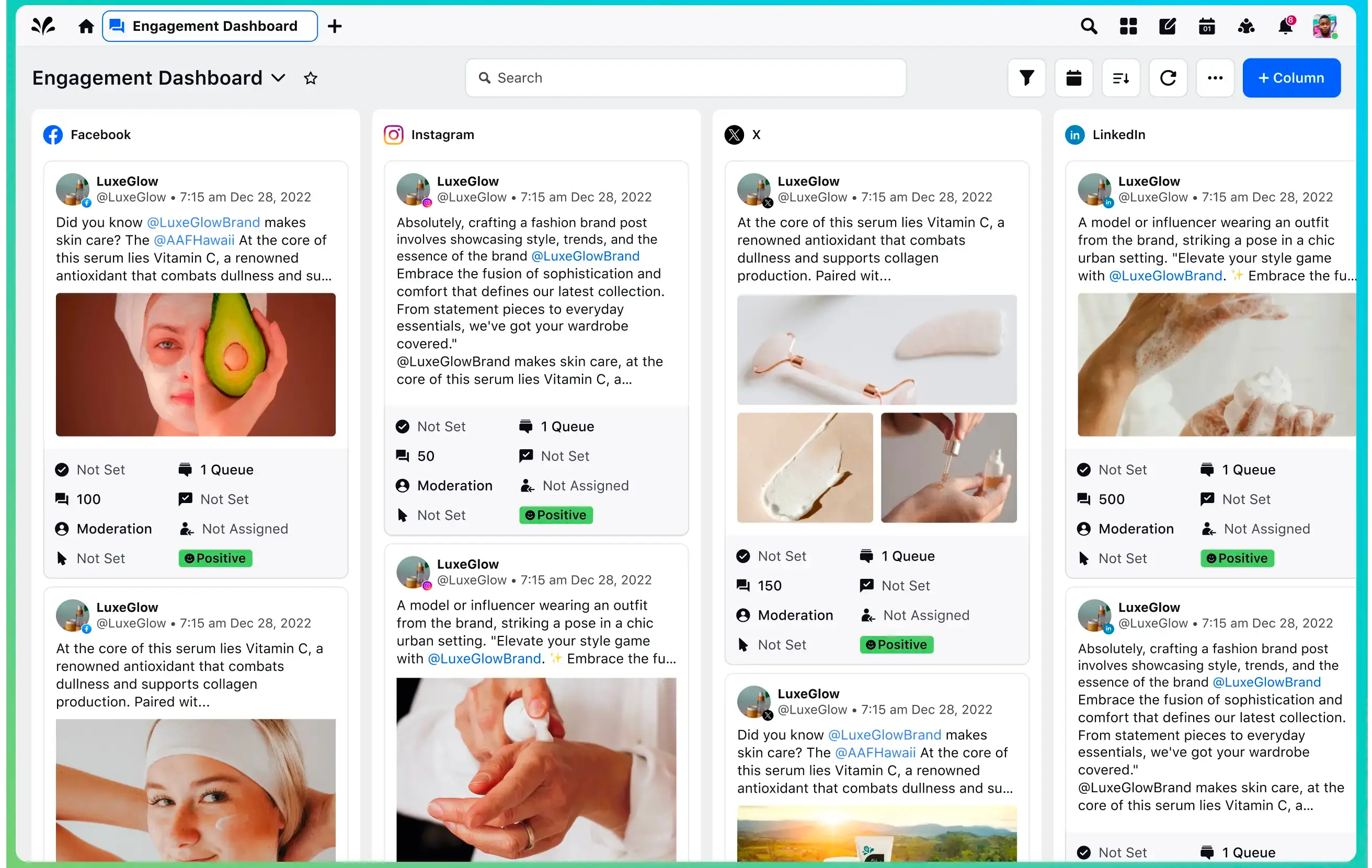

- A unified customer experience management (Unified-CXM) platform to facilitate communication, ensure compliance, and increase operational efficiency

- Highly scalable governance and granular user permissions

- Built-in AI capabilities that help your advisors be more effective and remain compliant

- A robust onboarding program with a learning management system to facilitate continuous learning and development in an ever-changing digital environment

- In-depth reporting and analytics to track success and pivot when needed

- Access to 30+ digital channels to meet your customers where they are

Some of the top global financial institutions trust Sprinklr Distributed. The only social selling platform rated 5/5 for user experience by Forrester, Distributed has better adoption rates, helps customers generate more revenue, and has more compliance protection versus competitors.