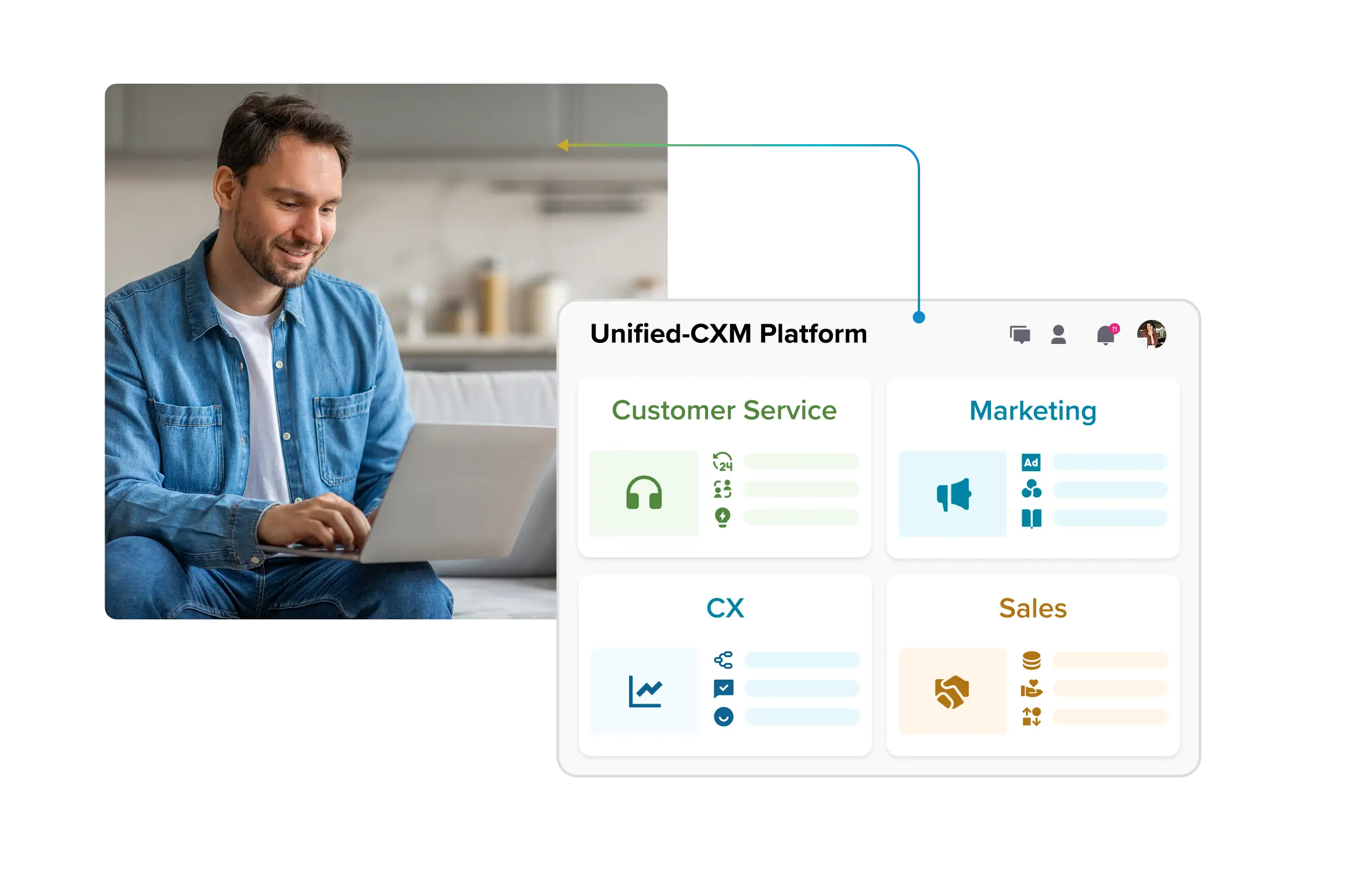

The strategic AI-native platform for customer experience management

The strategic AI-native platform for customer experience management Unify your customer-facing functions — from marketing and sales to customer experience and service — on a customizable, scalable, and fully extensible AI-native platform.

Episode #179: Your Complete Guide to Analyst Relations, with Drew Tambling

We’re back with our continuing Sprinklr Marketing Plan series. Today it’s all about analyst relations, a critical, yet often overlooked, part of your marketing plan. Drew Tambling, director of analyst and influencer relations at Sprinklr, steps through why it’s so important, how to get started, and explains why you should probably increase your analyst relations investment.

You can follow Drew on LinkedIn

PODCAST TRANSCRIPT

Grad

Do you hear? Oh? Oh? Yeah. Yeah. Go live now. Okay, so you digging the music groove? It’s kind of like,

Drew Tambling

I got a list. It’s …

Grad

… exciting. It’s like, you know, that’s the flight of the Valkyries.

Drew Tambling

It sounds like revolutionary like …

Grad

No, no, it’s not so much; it’s more like, you know, Apocalypse Now. So anyway, so welcome, as always to the Unified CXM Experience. And I’m your host, Grad Conn, CXO or Chief Experience Officer at Sprinklr, and today I’ve got a very special guest, Drew Tamblyn. Drew is the Director of Influencer and Analyst Relations at Sprinklr. And we’re going to be focusing on the analyst relations part of his role as we dig into the How to Write a marketing plan and in particular, the zero moment of truth stage. So Drew, welcome to the show, I’m going to give you a quick intro, kind of just cover off a little bit of your background. I’m going to frame up for folks just where we are in this series, because this is a kind of an ongoing series of how to write a marketing plan. And then I’ll kind of come to you and have you sort of fill in the pieces of your background I missed and then we’ll kind of dig into this. Does that sound okay?

Drew Tambling

Yeah, sounds good. Thanks. Thanks for having me, Grad.

Grad

Okay, good. And as always, our erstwhile sound engineer Randy is on board and on tap and Randy, are you? Are you on board and on tap?

Randy

On board and on tap.

Grad

Okay, are you excited?

Randy

I’m very excited.

Grad

You’re excited backstage? Good. I’m a little nervous, actually. Yeah, a little intimidating. Yeah, he’s just too good looking. That’s the problem.

Drew Tambling

You know what? I don’t know what it is. I get that a lot.

Grad

Yeah, no, you’re just really good looking. And so I think that just makes people feel intimidated, they want you to like them, right?

Drew Tambling

So I try to show up like unkempt and scruffy to kind of throw people off

Grad

That probably just makes it even worse, you know. Anyway, so Drew has worked with me now for like, three and a half years, maybe four years, I think maybe four years now. Right. We’re getting close.

Drew Tambling

I was one of your first hires, I think.

Grad

Yeah. Like kind of April of 2018, I think. So Drew was working at Gartner. And Gartner is one of the analyst firms we’ll be talking about today, along with Forrester and Constellation and many others. Drew was there. He was in Singapore. And I’m not 100% sure, exactly. You can maybe fill this in, Drew, because it’s sort of lost in the mists of time for me now. But somehow, we ran across Drew in Singapore, and managed to get him to move to Portland, Oregon. And he’s now relocated to Fort Lauderdale. So he’s sort of been sort of slowly moving east all the time. And he and I actually live quite close to each other because I’m in Delray Beach, and he’s in Fort Lauderdale. And you might say, “Hey, Grad, you and Drew probably hang out a lot, right?” And I’m like, “Yeah, you’d think so”. So let me go for a second on where we are. So we are talking about how to build a marketing plan. And so the concept that I introduced in the first episode on this series was, there are sort of three stages that I would look at. It’s a little bit of a different way of thinking about writing a marketing plan. But think about what you’re doing at the zero moment of truth, what you’re doing at the first moment of truth, and what you’re doing at the second moment of truth, we have covered all three of those in sort of overview form. And now we’re drilling into each one of those pillars with some special guests and some other discussions in terms of understanding how to think about those. So we actually talked about the zero moment of truth a few days ago with Marshall Kirkpatrick and spent a fair amount of time on how to think about influencers. Marshall did a really a nice job of kind of unpacking that for us. And that was a really fantastic interview. And, of course, Marshall, VP of Marketing is here at Sprinklr as well. So today, we’re going to unpack the analyst relations component of the zero moment of truth. And remember, zero moment of truth is the stage at which people are researching your company. In B2B, this can be the most important stage, because most buyers who go to your website for the first time have already made a decision to buy your product. So the zero moment of truth is critical in B2B, but in B2C, increasingly, people are making their decisions based on the word of others. And it’s this word of others that has driven the change in buying behavior across the internet. And so that’s why I think companies still have a tendency to think about, what am I saying about myself, and not thinking more clearly about how do they influence others to say the things about them that they want, so they get the kind of traffic and business that they need? So, so Drew, let’s first of all, just react a little bit to the zero moment of truth stuff. Tell me if you feel like that’s onboard, off board or maybe sort of add some perspective on that from an analyst standpoint. Remind me on how we found you. And then let’s just dig into this topic.

Drew Tambling

I like the terminology, zero moment of truth. It makes me think of a lot of things. And in particular, in a B2B cycle, you’re always thinking about funnel and where things fall within a funnel. And quite often here in analyst relations, that’s a tough conversation, because we see analyst assets, making themselves valuable at different points in journeys of the pipeline, and not necessarily just at that zero moment of truth, but it might have its most impact at that zero moment. So …

Grad

Let’s just stay there for one second. Yeah, you raised something that I had not thought of before. We have talked about buyer enablement quite a bit in the show, and I’m not sure I’ve got that parsed into the model correctly. And I’ve highlighted that I’ve noticed that there’s this kind of stage, sort of half stage, somewhere in there about buyer enablement. But I think you’re right, what happens is, a lot of times the assets that these analysts produce, are used by people internally to sell their peers on ‘this is a good decision to make’, right, like, you know, it’s not me saying it’s Sprinklr’s the best. It’s Gartner that saying Sprinklr’s the best. So, you know, if it doesn’t work out, it’s not my fault. I’m going with what the analysts say is best. Right? And of course, it always works out with Sprinklr, but it’s like, just, you know, you have to kind of like I think this adds that third party imprimatur that makes people feel comfortable about a decision and pushing their own peers to sort of align with them. How do you see that normally working? How do you see people requesting it? How do you see people using materials internally?

Drew Tambling

I think it goes so much deeper than that. And it’s much more human than that. So in a lot of instances, yeah, listen, in a lot of instances … are we talking about Sprinklr or are we talking about B2B technology sales in general?

Grad

Anything you want.

Drew Tambling

Okay, so let’s talk about it like holistically. Most enterprises, when somebody has made a business case over a prolonged period of time to invest in a technology like a Sprinklr or something else, they’re often spending seven figures, millions of dollars on implementing a technology like that, in hopes that it’s going to do what they’re expecting it to do. And some folks have tethered their career to the success of that program. And it’s a dangerous proposition. So in analyst relations, it becomes increasingly more and more important for the technology that you’ve stuck your neck out on the line to implement and do and run in the business to be validated by third party analyst firms, because that becomes the source of the truth. Right, it says we’ve enabled this technology and taken these risks, because these technologies have been validated by the best the best analyst firms in the world. And year after year, the retention of that business from a Sprinklr perspective becomes infinitely more simple if you can maintain those leadership positions and validation from third party analyst firms. Once we start slipping down the quadrants, then renewals become risky. So we’re talking about, is it this zero moment, or are there multiple moments and then of course, it’s that zero moment where people are going to be finding out about us for the first time. But what about for those folks that have tethered the success of their careers to the implementation of a specific technology, they need us to be validated continuously by analyst firms.

Grad

You know, at my beginning of my career at Microsoft, I was in Healthcare, and there’s a company in Healthcare, it’s an analyst firm called Klas (k . l . a . s), which is I think the initials of the founders and Klas is based in somewhere in the Midwest, and they control and own the whole Healthcare IT marketplace. You essentially live and die by your class rating, and would come out, I think, on a quarterly basis. And my God, we would like, pour over these things. And it was like, death by a thousand cuts or cheers of victory. There was just so much riding on it. And you really could not sell your software if you had a poor class rating, like you were just dead in the water. And if it slipped, to your point, it created a lot of problems. We would get calls from CIOs saying, “What’s going on? My board looks at this, my board looks at the class ratings of the stack I’ve put together and if it’s not best of class, I’m going to get criticized for it. You got to get this fixed”. It’s very interesting.

Drew Tambling

Yeah, you’re not even making the shortlist. That company class, by the way, has been really, really busy with the advent of technologies that have come out since COVID. And the requirements that are placed upon technology specifically in remote medical doctor-patient technologies and virtual stuff. They’ve been blowing up. But …

Grad

So how did we find you? Let’s cover that off real quick before we get into the rest of this because we’re going to get deep on the analyst stuff but we are like, you’re in Singapore and somehow Sprinklr …. like what all happened?

Drew Tambling

I’ve become a little bit of a digital nomad since COVID kicked off. Right now I’m in the Pacific Northwest. Shortly I’ll be back in Florida, and we can get together for a little boat cruise or something like that. We can do something fun. But you can find me on LinkedIn at Drew Tamblyn. You can find me on X, formerly Twitter and Instagram @drewtambs as well.

Grad

But Singapore? How did I find you in Singapore?

Drew Tambling

You didn’t. Your previous PMK leader, Mr. Paul Michaud, he found me in Singapore. It was so wild when it actually happened. It was an interesting time in my career. I’d spent eight years at Gartner. And most of that time helping Supply Chain Management technology companies to improve their capabilities with analyst relations, whether that meant improving their ability to perform in waves and magic quadrants or actually doing a number of other things. But at that time, I had been doing it for seven or eight years. And I was like, you know, I want to parlay this experience and start to learn something new. I’d spent seven years in the supply chain management technology space, I’m like, I want to learn a new market. And so I started putting feelers out there. And Paul and I got connected. And it just felt like it made a lot of sense. It was funny, because at that time, I was thinking, I want to go to a big tech firm, because I had had all this experience working with like Oracle’s and SAPS and AWS for years. And I was like, that’s the kind of place that makes a lot of sense for me. And after one or two conversations with Paul, I was like, this Sprinklr thing sounds pretty awesome. You know, what was pretty cool about it? For me, I had spent all this time in this back-office technology architecture and the mentality of business leaders and back-office technologies. It’s very much cost savings driven. It’s like how much blood can I squeeze out of this stone in order to make our business more profitable. But then just one or two conversations with Sprinklr, I was like, this is a totally different mindset. It’s how can I use technology to enable top line growth. And it’s more like this mentality of being growth driven, and aspirational, and hungry. And it’s a much more exciting space, because it’s kind of like this unknown territory. It’s like, you can go as far as you want with this, instead of this mentality where it’s like, how can I just squeeze a little bit more and get a little bit more cost savings out of this thing?

Grad

I got to tell you; I am so happy that you joined us. You’ve made such an incredible difference. And I don’t know how Paul found you. But kudos to Paul. Michaud is like, awesome. And so what a great story. And you’re right, I think I met you in my first couple of weeks on the job. I think I was like signing off on transferring you from Singapore to Portland.

Drew Tambling

Yeah, I came to New York. And let’s talk about this. This was fun. Because you came from a background that was a lot, a lot different than a Sprinklr, I mean, at Microsoft, and some of your other roles before that. But like, you hadn’t really done a whole lot of analyst relations stuff. And it was that first conversation we had, it was like, “Hey, Grad, so we got to have a conversation because I don’t know anything about marketing, but I know a lot about this analyst stuff. I’ve been doing it my whole career”. And I remember at that time, you told me something that I’ll never forget. You said, this is the first time we ever met, we were walking down the street. You said, “Drew, anything you’re going to learn about marketing right now will be irrelevant by the time you learn it. But if you can take the analyst stuff that you’ve spent a career learning and you apply it here, and you come with hunger and I think you said energy, and a couple of other things, you’re going to do pretty good”. So I remember at that time, you didn’t have a lot of experience. So you kind of learned alongside me and I taught you like, this is how it’s done. This is how it’s done. And those first couple of analyst briefings and stuff that you and I did together, not so great. But we’ve gotten really tight. And we’ve got a process now and we’ve and we’ve really, really zoned in on something that works. We’re getting results. I mean, even just this past week we got mentioned in our first analyst report as a C cast provider. And that’s because of the work that we’ve done.

Grad

That’s awesome. Who mentioned us?

Drew Tambling

It’s an analyst community forum called No Jitter.

Grad

Oh, yeah. I sent that to the LT. Yes. Probably read that. Yeah, we’ve been working a long time to get there. Yeah, that’s very cool.

Drew Tambling

Recognized as a newcomer into a market that a lot of analysts out there feel like we don’t belong anywhere near. So the mindset’s changing and that’s only happening through targeted and strategic analyst engagement.

Grad

Alright, so let’s figure out who we’re going to talk to now. So let’s frame this up as I’m a tech startup, doesn’t matter what space, right? I’m a tech startup and I’m in a space. a space that’s growing, because you know, I probably wouldn’t have done the startup if it was space (that wasn’t) . We’re not in peer-to-peer software, let’s put it that way. Okay, so we’re something like, you know, 21st century. And let’s say I’m in that sort of product market fit stage, and this is typically when I consult with and kind of connect with a lot of startups at this early stage, they’re kind of like 25 to 50 million in revenue, clearly, they got something going on, they probably got one or two customers that are maybe multimillion dollar customers, that would have been like me with Sprinklr back in, say, 2018, for the guts and proof of concept, now, that sort of working, and they’ve got some customers that, boy, if I could just get a hundred of these, I would be really smoking, and they’re growing quick. But they don’t really think about analyst relations, right? That’s not on their mindset, and then maybe some stuff’s coming on their category. And, and they’re in this kind of Challenger quadrant, suddenly, they didn’t even like no one was coming out. So they’re just sort of starting to hear from their board, you got to start to worry about this. So frame up, if you’re sort of meeting with that entrepreneur, you’re probably meeting with the CEO, because they’re probably not even a CMO in place yet. So you’re meeting with the CEO, and you’re chatting with them, how to think about it, how would you coach them up on how to think about analyst relations? How to get it started, the kind of people they need to hire to sort of make that happen? And what would the investment curve look like on how they should be spending against it?

Drew Tambling

Yeah, yeah, it happens all the time. And you can be certain that if there is a category that emerges, and there’s any traction with it, an analyst firm is going to cover it. And they are going to introduce an evaluative piece of research to that category. It happened just this past year, when COVID hit, and everybody’s conferences were canceled and all this stuff. Everybody needed to divert to a virtual setting for major scale industry conferences, right. So a whole technology category, I’m just giving this as an example, right, a whole technology category emerged. And there were already some companies that were doing stuff there, and then COVID hit and they’re like, “Oh, my God, everybody, we’re getting so much attention. We don’t even have the staff to really manage it, especially the demand that’s coming in”. And then of course, analysts tune into that stuff. They’re like, “Hey, there’s this new technology category that’s emerging, we need to cover it”. And then boom, all of a sudden, these nobody technology companies that we’re just kind of like hanging on to dear life are at the front and center of a category that never existed because COVID happened. That actually was a real thing. That was a technology category called Virtual Event Management Software. And it was led by Forrester’s, Laura Ramos. So she picks up this category was outside of her traditional coverage as an analyst, but it happens. And so what I would advise to companies that find themselves in situations like that is, first of all, it doesn’t cost any money to brief analysts. Right. So you can start you were asking me earlier, like, we at Sprinklr are a whole different animal, we have got five product suites, we’ve got, you know, years and years of development of an analyst relations program, and are doing a lot of different stuff. But to just get started, it doesn’t really take much or any money. So building those relationships from the ground up, can start in a briefing setting that you can request formally just through the formal Gartner and Forrester channels to do some introductory briefings so that analysts can know who you are, what the services that you bring to the table are, get to know your executive leadership team a little bit. And then we can start to build a relationship from there. I don’t think that that’s a very sustainable model for very long, you will need likely an initial investment to start to have more of a formalized relationship that gives you the ability to have ongoing conversations ad hoc and more frequently than just through the free briefing channels, which is a very limited channel.

Grad

Yeah, so let’s stop there for a second. Okay, I hear you, but I want to like double click on that a little bit, because one of the challenges with, particularly startup entrepreneurs, as soon as they hear you can do it for free, they immediately assume they can always do it for free, and they default to free really quickly. And what I’m kind of fond of saying when I’m in some kind of advisory capacity, is I’ll say that at sort of 25 to 35 million, the biggest line item in your marketing budget should be analyst relations.

Drew Tambling

Exactly.

Grad

And let’s talk about what’s in there. So, I mean, I only kind of skate at an overview level, because I’m mostly just like, this is stuff I learned from you. So you’re absolutely right. We’ll see how good a student I was. But a), you do need to actually staff a team, you need somebody at a minimum like yourself. And ideally, one or two supporting people in that department, like we have now. And you’re going to need to sort of section off engineering time. And other time of people who, you know, SC time to make sure that people can demo show and talk about the product in an intelligent and simple way. So that’s money, you’ve got to dedicate resources to that. Second thing is that there are reports and analyst studies that they do, and it’s easier to get the attention of analysts, and I don’t mean this in a, it’s not a pay to play. I think I have to be very careful here but it’s not pay to play. It’s not like, “Oh, if I’m working with Forrester, then somehow things are going to be better for me”. No, no, they’re still going to analyze you legitimately on your merits. But the closer you get to them, and the more work you do with them, the more easily you’ll understand them. And you’ll understand what they’re looking for because what they’re looking for is what their customers are asking. So it is, I think, an interesting way of creating customer intimacy by working more closely. And then the third thing is, just like how you take what you get out of analyst relations, and then leverage that in a marketing plan, like how do you talk about it on LinkedIn? And how do you allow your employees to do employee advocacy around it? And how do you do programmatic display advertising around and all that kind of stuff? There’s a lot of rules around that. But though those feel like three major buckets, so what am I missing? And then maybe we could drill into those buckets and help everyone understand how they make those investments and make those investment decisions?

Drew Tambling

Yeah, you’re pretty close. So wait, we have

Grad

Pretty close. What do you say, a B plus?

Drew Tambling

You say three categories. Actually the AR program that I run today has four core components.

Grad

Of course

Drew Tambling

So what I just talked about with briefing and inquiry, that’s our proactive engagement. So you can even think about these in terms of buckets of spend as well. So you have proactive engagement. That’s all of this stuff that we do to educate analysts about our products, our services, our programs, our innovation, our product roadmaps, our investments in the business. Evaluative research is a whole other thing. Now, that’s waves and magic quadrants, or other tier two, or tier three industry evaluations that we’re participating in, these take a lot of time they take, and that’s more of the capital resource allocation that you’re talking about, like, “Hey, we’re going to need 20 hours of our CEOs time for this one Magic Quadrant, right. And that’s serious money, it might not cost anything to participate in a waiver, Magic Quadrant, but the capital that you’re investing in terms of resources around the business, from product to your executive leadership team, product marketing, and of course, your analyst relations resources, it’s costly to participate in a wave or a Magic Quadrant, it’s probably more costly to do a wave or a Magic Quadrant without knowing what you’re doing. But nonetheless, still costly. And then my third bucket is commissioned research. So this isn’t a free thing. Commissioned research doesn’t exist for free, okay. So it’s something that you need to be thoughtful about. But you are working in collaboration with a Forrester or a Gartner or a different analyst firm, to create thought leadership, or ROI analysis or benchmarking exercises that validate your market position with a third party, unbiased Forrester Gartner logo. This is a really big one, because that’s a huge lead generation opportunity for your marketing engine. And the last bucket is our paid engagements. And this is a little different than commissioned research because this is paid engagements. And the way that I think about it is how is it’s strictly like webinars, speaking opportunities and opportunities for, in a closed-door setting, for an analyst that’s in your space to meet with your executive leadership team or your product management team to talk about competitive intelligence and figure out how you can turn the needle in terms of influence with an analyst.

Grad

Yeah, and I think that, again, I sort of sometimes see people, maybe roll their eyes a little bit and kind of like wink and go, “Oh, yeah, like, you know, if we pay them, then they’re going to give us a good rating”. And I, I really try to disabuse people of that notion really quickly, because it’s very cynical and inaccurate. But what does happen, and let’s talk about this a little bit, there’s a virtuous cycle that I have seen happen. I’ve seen you lead this right. So I, again, sort of, I’m the student here, I’ve seen you lead this virtuous cycle where the ongoing engagement even when they’re like speaking at our events, you know, which we will pay for that. That ongoing kind of intimacy with the analysts makes us smarter, not just about how to talk to them, which I think is partly true. But more importantly, I think how we should be evolving our product development, and how we should be thinking about talking about our product and how we should be pitching our product to prospects. And just because you’re in the ecosystem of the people who are very close to customer queries, because I think what people miss is that the analysts get queries from companies all the time saying, “Hey, I’m looking for a C cast provider, who would you recommend?” And then they’ll ask a bunch of questions. And all that back and forth informs them in a way that it’s very difficult for us to get that insight. So talk to me a little bit about the pay to play cynicism that people sometimes have. And then talk to me about how you would reframe that mindset to get people to think about it in the proper tonality. And then let’s talk a little bit about numbers. I’ve got, say 35 million, I’m probably spending eight to 10 million on marketing. How much of that would you spend on analyst relations? So let’s break that down a little bit.

Drew Tambling

Yeah, so the pay to play stuff that comes up in every conversation that I ever have, when I’m talking with somebody, And the truth is this, Grad, there are levers that you can pull, and there’s levers that you just can’t pull, like there’s influence to be had in some paid engagements. But in the big, heavy things, there’s not a whole lot. So I’ll also mention this, from an analyst perspective, if you’re an analyst at a Gartner, Forrester and I’ve been there, right, you likely have no idea how much a Sprinklr or any other vendor that you’re talking to is spending with your company, if any at all. You just don’t know; you don’t have access to that information. So if you’re an analyst, you’re sitting there and you don’t have access to a CRM that tells you, “Oh, Sprinklr, we got to pay better attention to them because they’re spending this much money”, or “Oh, hey, Sprinklr, we’re only going to give them a little bit of air service, because they’re not spending enough money with us.” That doesn’t exist. Analysts don’t know how much you spend with them. They have no idea. But there are some levers that you can pull that that do drive influence. And it’s not because of the money that’s attached to it. It’s because the activity is because of the engagement. It’s because of that opportunity to build relationships and sentiment and gain mindshare between somebody. I always tell people this; when you’re starting a path with a new analyst, what I want you to focus on the most is finding those areas of commonality, where do you agree on things, have baseline conversations about the things that you agree on, build rapport, and then, only then, can we start to introduce some conversations that challenge some things where we see things differently.

Grad

One thing I think our founder does really well, Raji, is he’s always been hardcore on reading the last year to two years, depending a little bit on the rate of publishing by the analyst. But he’ll read ten, fifteen reports written by the analyst we’re about to meet with, and he’ll have those in his brain, and he’ll know what their perspective is. And you’ll see Raji in meetings actually, referring to comments they’ve made in previous studies, and either saying, “we agree with that, that’s consistent with our point of view”. Or he’ll say, “you said it was, you know, x, and we actually think it’s y. This is why our point of view is different from yours”. But he’s always very clear to show, I think there’s two things that are happening there. One is a great sign of respect to the analyst that you’ve cared enough to read their work, which they obviously spent a lot of time on, is important to them. And number two, you’re getting into their heads so that you’re talking to them in a way that they can understand where you’re coming from, and they can frame you correctly. And Raji is very hardcore on that practice. And you’ve brought that now into kind of common practice with the whole team, you distribute everything in advance, you do a great job of making sure everyone’s sort of coached up and kind of connected to all the right materials. But let’s talk about that a little bit, like understanding the analysts you’re going to be working with and spending time reading those things, which I also think is also a virtuous cycle in terms of the company.

Drew Tambling

Totally. And I’ve been part of a million conversations with analysts where there’s so much friction because there’s disagreement. And it never goes well at all. Never goes well at all. It’s going to hurt you in the long run. But when we create these avenues of things that are paid engagements, like let’s say we’re doing a commission thought leadership piece, or we’re doing an ROI analysis or something that gives, I’ve created then a platform for folks like you or folks like our CEO, Raji to have one to one engagement over a prolonged period of time in order to help an analyst get to a finish line of a publication that we’ve yeah, okay, we’ve sponsored it. But when that thing comes out, we’ve got mindshare. We’ve agreed on a hypothesis, gone out together to prove it and then published it together. And that’s something thing that doesn’t change easily. And through the act of that engagement, we’ve not only just proved the hypothesis that is a universal truth of our value proposition with the analysts that we care about. But if you don’t have a good understanding of how analysts, analysts are like KPId in their own roles, then you don’t really have a really good baseline for understanding what levers are good ones to pull and which levers are not good ones to pull.

Drew Tambling

So an analyst is just like any one of us who work at a company, they have performance KPIs, right. And I don’t think that this is too much secret sauce. But some of these engagements that we tend to leverage that we will pull at our paid engagements are going to help our analysts that we care about be more successful in their roles than other ones that we could pull that don’t really impact their performance at all.

Grad

Interesting, I’d not thought of it that way before. I like that. That’s good framing.

Drew Tambling

So yeah, and there was one thing too. That the same thing goes for your support team, too. So if you’re working with Forrester, Gartner, you’ve got your analyst community, but you also have a whole host of other people that you work with; they’re project managers, they’re account managers, they’re research coordinators, and you want to enable all of these people that support your organization. Here at Sprinklr we’ve got a dozen people at Forrester, a dozen people at Gartner that support our contract or support our account with them. And it’s my job to make sure that every one of those people on the journey, to my best ability, are being successful in their roles, because they’re going to be that much more able, willing, and, you know, hungry to help us in the future when we need it. Let’s say Grad needs to talk to an analyst yesterday. And I need to make that happen. Typically, through normal channels, it might take a couple of weeks for that to happen. But you might have a meeting with the board this week. And you need to get some information, or you need to get a sounding board. And probably make that happen. If we’re enabling our account teams to be successful, too.

Grad

That’s awesome insight. I love that. So let’s talk about budgeting. So you know, I’m spending eight to ten million bucks on my marketing budget right now, I’m not spending any money on analyst relations, haven’t really thought about it. You know, here’s Grad and Drew like pounding the table and saying, “Hey, this is really important. You got to do this”. The CEO, I’m thinking wow, what do I carve out for this? How would you think about that?

Drew Tambling

Well, as a baseline, you need entitlement to their research services, which will also give you access to analysts, and it’s usually unmetered. So you can talk to the analysts as much as you’d like to. For a firm like Gartner or Forrester just an entry level access and entitlement to Research and Engagement Services is going to cost you between 50 and 100 grand. So I would set aside, just to get a relationship started, a couple hundred bones, and that should get you going. But then we can talk about like taking it to the next levels. Like when you’re at a point where like Sprinklr is, we’re a public company now, are you allowed to talk about revenue about Sprinklr on this thing? Or what?

Grad

No, we don’t do that. Well, we would only share, I guess we can, we would only share what we’ve shared publicly. I don’t talk about Sprinklr a ton on the show. I talk about unified CXM mostly, so we could say that in the last earnings call our CFO did reveal that we have a half a billion-dollar run rate. I think that’s where you were going, right?

Drew Tambling

Yeah, that’s where I …

Grad

That’s public information. So anything that’s public we can talk about and that was right on the earnings call. So yeah, we’re at a pretty decent scale. Right. We’re 10x versus this theoretical company that I’m talking about.

Drew Tambling

Don’t quote me, but I think it’s right in the ballpark – 10% of our marketing budget.

Grad

Really? Wow. Okay. Well, we can’t talk about what our marketing budget is. So we’re going back to our eight to ten million marketing budget. See, I’m taking us to the Series C Company because I want to keep it really far away from Sprinklr. See what I’m doing here? And so in the so Series C, so I’m spending eight to ten million bucks, you’d be saying you should be spending 800 to a million bucks on your Analyst Program, which does sound right to me: things like an analyst event. Let’s talk about that. That really hasn’t come up yet.

Drew Tambling

That’s a totally different poll. You might need to double the budget just to do a successful analyst event.

Grad

Okay. Okay. So what would an analyst event look like? And why would you do it?

Drew Tambling

They’re lavish and a lot of the competitors in our market in particular, like especially C cast market and other front office marketing technologies. They put together some serious analyst events.

Grad

You were telling me about one … don’t use any names. So don’t use any competitor names here. But you were telling me about one that I think involved helicopters because I felt like this is just to give people an example and this is not a crazy big company. And this is not a crazy over the top analyst event, but just to give people a taste of what’s going on out there.

Drew Tambling

You remember the example? I would think that they are over a billion in revenue.

Grad

I’m pretty sure getting close to that.

Drew Tambling

Yeah, yeah, something in that ballpark. Okay, so they did the whole Yellowstone like experience? Do you watch Yellowstone yet? No? Oh my god, you got to watch it.

Grad

No, everyone tells me you have to watch. I’m still working my way through the new Sex in the City. And I’m re-watching Billy in Season Three, so I can watch Season Four and understand it. My plate’s full right now.

Drew Tambling

You’re going to lose the month of your life in Yellowstone, and you’re …

Grad

I’m almost afraid to watch Yellowstone. So many people have told me how much I’m going to love it, I’m afraid to actually watch it. So I know, I’m just going to, like, disappear for a while. And you know, they’ll be sending like search dogs for me and stuff like that.

Drew Tambling

This company, which also is kind of one of our competitors. And I keep an eye on this stuff. Because, you know, it’s a very similar pool of analysts, right. So they flew everybody into either Helena or Billings, Montana. And from there had each person picked up in a helicopter, flown into a private ranch in Montana, where they had an analyst summit over the course of several days. And they did, of course, all of the stuff that you do in an analyst Summit, where you’re doing product information, you’re doing a CEO address, you might invite a guest speaker, you’re doing product demonstrations, you’re doing all of the stuff that needs to get done. But in addition to that they did a gun range thing that happened, there was horseback riding that happened, of course, the sightseeing tour around the Teton mountains with helicopter rides. These things get pricey and there’s no ceiling to it.

Grad

So how many analysts do you think they would have invited and how much do you think they spent on that event?

Drew Tambling

I think they invited between 20 and 30 analysts and influencers. I think that they spent seven figures on that event.

Grad

Like more than a million dollars. Wow. But that’s a smart company, that’s a company that knows about the zero moment of truth, it understands that this is where the buying journey starts. And if they get it wrong at that stage, you can’t really turn it around with a bunch of programmatic display ads, you’ve got to, you’ve got to get it right.

Drew Tambling

That’s a market where a technology company like that is getting 75 to 80% of their leads straight through analyst relations. I mean, that’s their whole game.

Grad

Right. You may look at your marketing plan as primarily an analyst relation plan.

Drew Tambling

That’s a category where a major (and a couple actually) major analyst evaluations magic quadrants or wave have existed for that category for 20 years. And if you’re not a leader in that space, then you aren’t on a shortlist. Nobody’s considering buying unless you’re a leader in that space. And the leaders in that space have maintained their leadership for over a decade.

Grad

People are probably dying to know who we’re talking about; we’re not going to tell you … unless you pay us a lot.

Drew Tambling

They also say this, Grad. it’s pretty common for analysts, for firms like a Gartner, they report that as much as 50% of category revenue is owned by the leaders of that market. So if you’re a leader in a Magic Quadrant, 50% of the market category, of course, Gartners and Forresters, they create their own market category. So do with that what you will, but 50% and typically, on average, there’s usually three or four leaders in every evaluation.

Grad

That sounds about right. Yeah. Three companies. 50%. Yeah. Sounds about right. Yeah. All right. So you had mentioned in our sort of pre-briefing that sometimes there are unintended consequences so talk to me a little bit about that. I can’t wait to hear this.

Drew Tambling

So I’ve had a really cool journey here. So it’s been four years, and I was the first of my kind, there was no analyst relations department before I came. And one of the coolest things and the most proud things that that I encounter on a daily basis is when you’re in a company like Sprinklr that’s gone through an IPO and grown so fast. I mean, we were grabbing over 1000 people when you and I joined, and we’re what are we now?

Grad

I don’t think we’re public with that number. But many, many,

Drew Tambling

So it’s, it’s many x’s, many x’s. People every day, hit me up on Slack and send me emails and stuff internally. When, for example, my newsletter publishes, I’ll get emails from people. And they tell me that Sprinklr’s recognition as a leader in various categories that we participate in, MIT waves and Magic Quadrant specifically, was a determining factor in them joining Sprinklr. So recruiting, it’s a huge recruiting tool.

Grad

That must feel great. Look at the thousands of lives that you’ve influenced. By the way, for the audience, you publish a wonderful newsletter. We’re actually working on a newsletter right now. And we’re using your template as our base template. And it’s called Analyze This, which I thought was super-duper fun. Nice template though, all done through Sprinklr, too, all powered by Sprinklr. A beautiful job on that so I really love your ….

Drew Tambling

When you go when you use your template, make sure you run it through the brand team because I got …

Grad

Check. Yeah, I know. I always talk to Jan, but I loved what you did. Nice, nice piece of work and well-written with lots of punchy like, What? Why? What am I learning? It was really well done in terms of value.

Drew Tambling

Credit to Karen Orether, our analyst relations manager on my team.

Grad

She’s awesome. Thank you, Karen. Great work, great work, it’s really a great piece of work. Okay, so keep going – unintended consequences,

Drew Tambling

Recruiting. So number one is recruiting, and number two was, I never expected this to happen. But one of the biggest bright spots of my career so far here at Sprinklr was going through an IPO. Nobody ever tells you that this is going to happen. But there’s a huge roadshow. Grad, you were probably in the room for all this stuff. And you’re going around to all of the different investment institutions that are going to help you get to a financial milestone like that. Slide number two in that deck is all of the analyst relations trophies that you’ve collected over the years. And it’s the industry’s way of validating the strength of your technology and the viability of your market.

Grad

So I thought when you said the highlight of your career, just for a second, I thought you were going to say working with me, but I, I guess I’ll still go focus. I’ll focus more; I’ll try to do better.

Drew Tambling

I’ve learned more from you than anybody I have in my career. Well, I’ll give you that insight. For better or for worse.

Grad

You don’t have to say that. Oh, for better or for worse. Oh, good and bad, right? Yeah. Mostly, I’ve learned what not to do. I actually said that to my dad once. He was like, “Yeah, what lessons have you learned from me?” I said, “Oh, a lot of things about what not to do”. I don’t think he appreciated that very much. But you know, it was true. Alright, so this has been great. So I’m, I’m feeling like, if I’m talking to this CEO of our theoretical Series C Company, I think he’s thinking, wow, I’m really not investing what I should be investing here. And I’m not thinking about this in as holistic and sort of deep way as I need to. So let’s coach this person up a little bit because it’s also a little overwhelming, like, where do I get started? And how do I find a Drew? And I mean, we had to go to Singapore to find you. It’s, you know, halfway around the world to find you. You know, people like yourself are not just falling out of the trees. So what do I do next? And how do I get going? And is there a way for me to scale this with a vendor model? Or how do I get rolling more rapidly while I wait to find like my perfect analyst relations person?

Drew Tambling

So first, the first things Forbes published an article this past week, the top 15 jobs in demand in 2023, and number 10 was analyst relations. Number 10. This is the Forbes article. People are recognizing how important this is, in terms of really scaling businesses, especially in B2B technology. I would say this, I would say if you’re a Series C, and you haven’t gotten your foot wet with analyst relations yet, first of all, you need to do a little bit of analysis in terms of what’s the scope of analyst coverage for your market, if you’re a Sprinklr, and you’ve got several product suites that have (we track 60 to 70 analysts across five different markets) and it’s a very, very complex ecosystem of analysts, right. So you need to have some serious resources behind a program that’s going to be successful for a company like ours, and technologies like ours, but in a lot of markets, like you might be a technology that’s in, you know, like identity verification, or proofing, or something like that, that has much more of a narrow focus, right, you’re essentially a point solution, right. And it’s a deep category that has a lot of tenured analysts in it. But maybe there’s only five or six analysts that are really going to move the needle in terms of your analyst relations program, and what kind of earned side assets you’re going to get out of that program. If that’s the case, then you’re going to take different approaches to it. If you’re a Sprinklr more on our side of the fence, you’re going to need to dedicate some time to looking for somebody that’s like me has a background similar to me. And it’s not a cheap investment, and you’re investing in a program and you’re going to have to like, understand that with this type of investment comes, hey, we’re going to find somebody that’s capable and has deep level experience of doing this kind of thing. But also, that’s just the beginning of the investment because what you’re going to invest in the program is going to be a factor more four or five, six times more than that. But if you’re somebody that operates in a point solution, and you haven’t yet started to tap into the value that analyst relations brings you, I would actually probably advise that CEO to start with a firm, right? So there’s lots of different analyst relations, consulting firms that are around for a fraction of the cost of bringing a Drew, can start to really turn the needle,

Grad

Well, your pizza budget alone is crazy. Like, I’m just going to put that out there. So it’s really, really off the charts. So what would be an example of an analyst firm? Do you have any?

Drew Tambling

Yeah, there’s one that I’ve, (I’ve actually looked into augmenting some of our capabilities with firms before) there’s one that’s called Spotlight. There’s another one that’s called like, ARInsight. There’s one that’s based in the UK that’s quite big as well, I can’t remember the name off the top of my head. Maybe we’ll put it into the notes here in your podcast, but, um, for a fraction of the …

Grad

We don’t have any notes. No notes. It all happens here in real time. We don’t edit it either. So …

Drew Tambling

This is just going to be straight raw all the way.

Grad

Always raw. Yeah. Like I make publicly available.

Drew Tambling

Yeah, well, okay. So

Grad

It makes Randy happy. So, right, Randy? it’s the mistakes that are fun. And sometimes I feel like Randy throws me just for the hell of it. Show Notes, and we do have show notes.

Drew Tambling

We will have show notes. So back on track. A firm like a Spotlight would be really good at sort of like the coordination of analyst activities that need to happen. And they’ll also be pretty well equipped to coach your executive leadership team into discussions that need to happen. So they’ll coordinate all that stuff, they’ll manage the relationship, and then they’ll coach your executive team, just to have those high-level briefings and inquiries that you need to do to establish relationships. Once you’ve done like established relationships, and you see the direction that the relationship is going in, you can then start more casually slowly looking for the right fit to manage a program. Getting started, you don’t need to find a Drew, like there’s other things that you can do.

Grad

That’s great coaching.

Drew Tambling

And this is not my bid for Grad to replace Drew with an analyst.

Grad

Oh, and he slowly puts down the phone. No, no, that is actually that is good advice. Because part of the problem that all these startups are having is just finding people, it’s become really challenging. And it’s getting difficult to scale a lot of these things. And they’re sort of sitting there waiting to find a whole bunch of very important roles that are difficult to hire and difficult to find. And it’s tough. And I’ve seen more and more sort of agency-like models springing up in all sorts of different ways. And you know, actually, I’m a big fan of that model. I mean, when we built the Customer Experience Center at Microsoft, we scaled it by using JeffreyM. And we had a vendor-based model where they were called Orange Badges so they had access to Microsoft facilities, they had a Microsoft badge that was slightly different. The blue badges were full-time employees and orange badges were vendor employees, but they had kind of full access. And you could work with them as like they were internal employees, but you also had the flexibility to manage them like a vendor. And so that model worked. It took us a while to get to that. We failed two solid, resounding times before that. But once we got that model, and the JeffreyM folks are amazing, too. So that that just sort of worked. But I think that model in these spaces, I always, whenever I am kind of advising, I’m always saying, look for that to scale right now. Because you might need to scale back or you might need to scale up super-fast. And in both cases, it’s really hard to do it with a full-time employee perspective. That’s great. So, Drew, this has been awesome. I appreciate the time. This has been really fantastic. What else would you give our theoretical CEO as advice? Or what advice would you give people generally who are thinking about analyst relations, this is kind of a chance for you to kind of put a button on all this, like, the one thing you should make sure you do is you know, never open the hood at 60 miles an hour or something like that. Right. So what’s the thing that you would say? The kind of thing you’d really focus on, really think about? And then we’ll wrap, if that’s enough,

Drew Tambling

Hmm. Yeah. Uh, so analyst relations as a practice isn’t going anywhere. Firms like Gartners and Forresters are only continuing to grow. There was a time eight years ago, ten years ago when I started at Gartner that our share price was trading at $13 a share. Gartner trades at $350 a share today. The company has grown so big and their whole growth strategy is based on acquisition. If you look at adjacent functions within the marketing organization like customer review sites and competitive intelligence, Gartner is acquiring the G2 Crowds and TrustRadiuses.

Grad

So they have a Peer Insights now, right. That’s the Gartner …

Drew Tambling

Yes, yeah. … in a natural extension. Yeah, I’m going to say it here. In the next three to five years, either a TrustRadius or a G2 Crowd will be acquired by Gartner. That’s how they grow. That’s what they do.

Grad

We’re Forrester for them or a Constellation?

Drew Tambling

We’re Forrester for them … or a Constellation, sure. Could be any of the above. There’s a hundred other little firms out there. So the discipline of analyst relations as a career path is going to continue to stay in place, it’s going to continue to grow. And some of the capabilities that you need to be able to do that job effectively, are going to grow, and it’s going to grow into some competitive intelligence, it’s going to grow into some customer engagement functions. So I don’t think it’s going anywhere. And if there’s anything, people that are thinking of breaking in, I think the best way to break in is kind of the path that I took. There’s great opportunities that firms that are analyst firms to get into and understand how that machine works, right, there’s been nothing that’s been more effective for me in my career, than understanding how the levers inside of those systems are pulled, and what they mean when they are pulled. Because on my side, now, I’m able to effectively use those tools to drive influence. And I think that that’s probably been the biggest asset of my careers, you know, being able to take that experience and parlay it into a role where I’m actually helping a company grow.

Grad

Wow, that is a great, that is a great summary, great button on this, I really appreciate that. And Drew, I’m just going to say one more time, I really appreciate you. You have done an extraordinary job for Sprinklr. Really, I mean, I didn’t find you. And I guess I sort of signed the offer papers and stuff like that, but it was Michaud that really brought you in, which is like Paul did a great job there. But man, it’s just been amazing. I really valued and really enjoyed working with you. And our relationship has been fantastic. And just seeing you continuously up your game, as we’ve continued to kind of expand the number of categories that we’re in, like it really is a monster program now and it didn’t start out that way. So you’re just doing an incredible job. So thank you very, very much. All right, well, I’m going to wrap now if you don’t mind. And do you have anything else to add or do you have any kind of like, you know, website address or link or anything?

Drew Tambling

No, no, thanks so much for having me. This has been super fun. I’d like to come again, please have me again sometime.

Grad

You’re welcome anytime. All right, for the Unified CXM Experience, I’m Grad Conn, Chief Experience Officer at Sprinklr and today we were interviewing Drew Tambling, who’s the Director of

Analyst Relations and Influencer Relations at Sprinklr. Drew gave us his insight on how you can use analyst relations to leverage the marketing motions of the zero moment of truth and we’re going to talk about reviews pretty soon in the next zero moment of truth piece, and we’ll be obviously digging into the other pillars. So that’s it for today, and I’ll see you … next time.